Ava Risk Group (AVA.AX)

Ava Risk Group is a world leader in risk management technologies for critical assets and infrastructure. The group is made up of 3 companies: FFT, BQT and GJD. They all provide different solutions to the most security-conscious commercial, industrial, military and government clients in the world, boasting customers like the US border patrol, US/ Aus military, US air force, Shell, BP, Woodside, Credit Suisse and many more.

Ava is at a really interesting point in its life, simply looking at historical financials or the share price, tells a very misleading story. The story is blemished by a large contract with the Indian Ministry of Defence, divestment of its largest division, large capital return, Covid delays and an acquisition. However, any investor diligent enough to dig through the mess has the potential to uncover a fast-growing business, with strong momentum and tailwinds, in a highly competitive position, in which management has flagged rapid expansion in the coming years.

Through the first 3Q of FY23 Ava has seen 84% growth in confirmed sales orders (46% excluding acquisition) with full-year guidance revenue guidance of ~$29m up 50%+ on the previous year. Before I get into the business operations I think it’s best to go look back at Ava’s recent history

History

Since its IPO in 2015, Ava has struggled to gain sustainable business momentum, being a projects-based business Ava has seen very lumping results.

Ava’s historic financials:

Indian Ministry of Defense contract - In November 2019 Ava received its largest order yet of $17.5m AUD to protect data communications cables for the IMOD. A very large win for a business of this size, contributing to the 2021 financial year. This large contract could have been a killer for Ava, way beyond their existing production capacities. However, Ava prudently licensed off the contract to an Indian manufacturing company, installing the software remotely from Australia. Licensing off the manufacturing allowed Ava to yield an extremely high margin shown in the large increase in profit in 2021.

Covid- Like many businesses Ava had its Covid woes struggling to get on site and install their products

Divestment of the services division- In August 2021 Ava announced the divestment of the services division for AUD $63.1 million resulting in net cash proceeds of AUD ~$42 million, a return of ~587% (including retained profits) on the initial US $5m invested into the business. Ava divested their largest, most profitable segment to focus on the expansion of their technologies. (Services division was a transporter of high-value assets/ goods around the world)

2022 Profit excludes cash realisation of divestment

2023 is guidance

Business Segments

Future Fibre Technologies( FFT)- Provides solutions for intrusion detection/ perimeter protection, pipelines, data networks and any physical asset you might want to protect. FFT Implements their technology into fibre optic cables, which work by transmitting data through pulses of light to detect any intrusion of surrounding assets. The technology incorporates ai/ machine learning to understand the different sites to help lower false alarms. The simple technology has very wide applicability to any physical asset, and the versatility of fibre optic cables has allowed them to enter different verticals like their most recent product Aura IQ. Historically All of FFT’s products were based on security and intrusion detection, however, Aura IQ uses fibre optic cables for condition monitoring of mine conveyor belts helping to detect any issues/ malfunctions, locate them accurately and improve the safety and downtime of a conveyor belt. Below you can see graphics from the company websites.

You can see from the figure below that FFT has many blue-chip customers, and is no doubt an industry leader in this space, with various military and government customers worldwide. The value of the FFT technology is:

Long range- can span 100’s of km long

Durability- can handle very rough terrain

Accuracy- can pinpoint intrusion detection to the metre, and can be integrated with cameras or any third-party systems to improve accuracy

low cost- Very cheap compared to other intrusion detection systems to implement and maintain

False alarms- FFT’s main moat is around the accuracy of their machine learning. Although they can’t guarantee anything they can all but just guarantee that after their system has been implemented for 1 year there will be no false alarms. Once the Ai has understood the environment Ava’s technology can reduce false alarms, from things like weather, animals etc to practically 0, and they believe they have the most accurate system in the market

BTQ

Btq is a manufacturer, developer and supplier of high-security cards and biometric readers, electromechanical locks and related electronic security products. Think of any hardcore security for a bank, government facility ect. I haven’t been able to find any high-level competitive advantage of their technology, but this is necessary tech for many businesses and as you can see below they also have many blue-chip customers and are obviously doing something right.

GJD

GJD is a security equipment designer and manufacturer, specialising in security space detection and intruder detection systems. Its products include professional-grade external detector equipment as well as infrared and white-light LED illuminators and Automatic Number Plate Recognition cameras. GJD was a strategic acquisition by Ava in July 2022, as GJD is based in the Uk and mainly operates in the European market, contrary to BQT which will allow Ava to enter a market not previously penetrated by BQT and vice verser allowing for cross-selling opportunities. GJD’s partners and customers are seen below:

Business Outlook

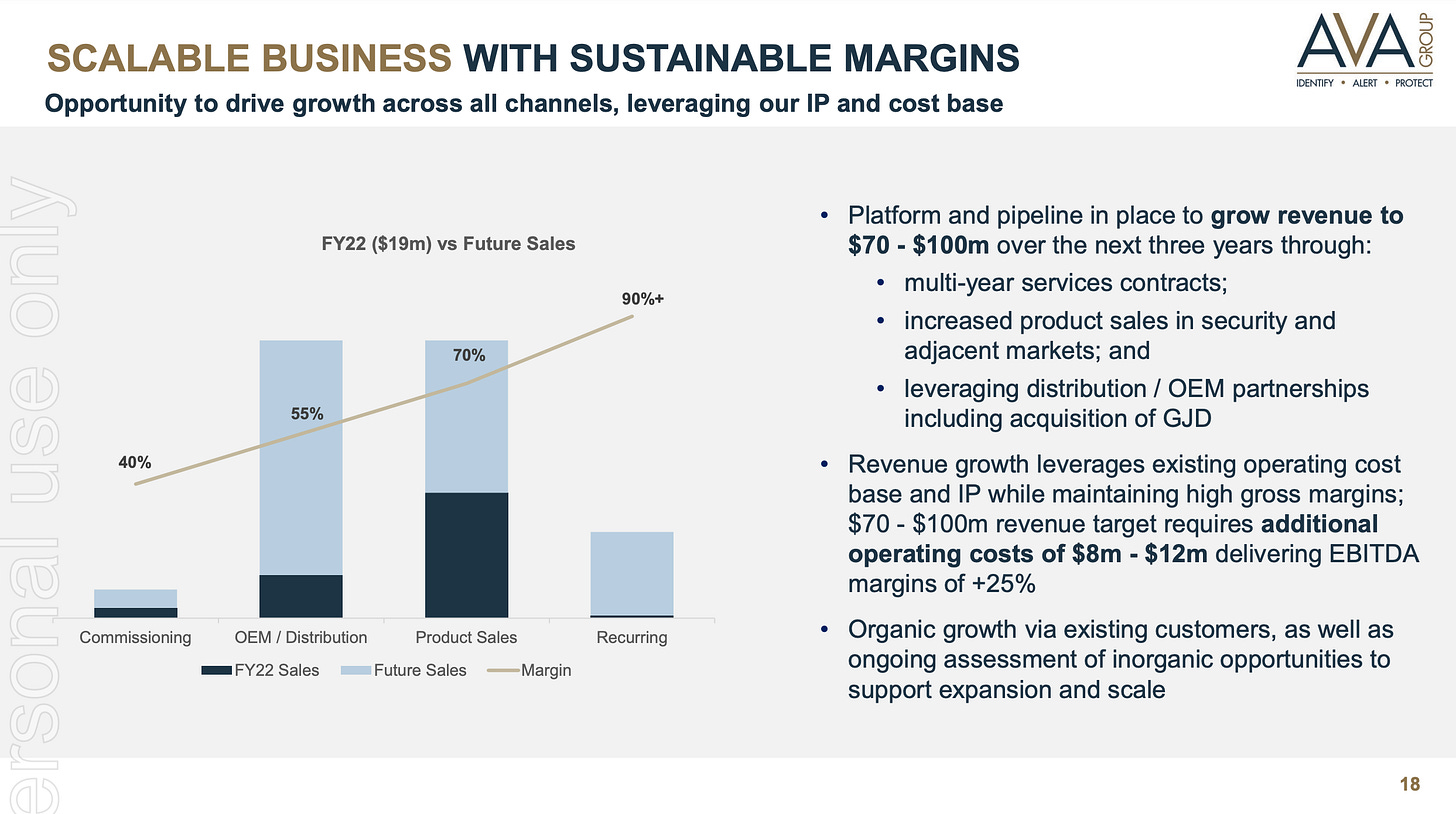

You can see from the H1 2023 presentation management has flagged the opportunity for exponential growth over the coming years, with 2023 revenue looking to be in the range of $30m management believes they can substantially grow this and are begging to execute. Before I bought shares I was quite sceptical given the lack of growth in previous years, however, they are beginning to execute on these targets with various growth pathways and expected organic revenue growth of ~50% for FY23.

Proven track record- Ava is now at an interesting point as they have continued to grow and develop their products especially with FFT where they are a market leader boasting proven products with high-quality customers but have minimal market share. Former CEO Rob Broomfield highlighted this, (paraphrasing) ‘Our customers tell us we have the best products in the market, we just need to expand our footprint’

Dormakaba- For anyone who’s followed Ava would know that Dormakaba gets bought up a lot by management, which probably highlights its significance. Dormakaba is the largest distributor of security products worldwide, BQT has recently signed with them and it seems management is quite excited and has flagged strong growth to come from the relationship

Growing sales team- Ava’s recent hiring of Jim Viscardi as head of sales also seems to get mentioned a lot by management. Jim has vast experience in security sales and since his hiring Ava has seen significant growth, and you can see through company sources the global sales team is expanding.

Cap-Ex/ security tailwinds- Demand for physical assets and infrastructure will only continue to grow, along with this will be the security/ monitoring of these assets, and Ava is well positioned going forward to capitalise on the tailwinds

Recurring revenue- With thousands of sites worldwide that all pay for the products upfront Ava is expanding its model to incorporate recurring revenue (mainly through FFT) by upgrading/ maintaining the software

Operating leverage- You can see from the figure above the operating leverage within the business if sales expand. Given the large fixed costs associated with manufacturing and transportation, it would be expected for a business like Ava to have strong economies of scale and operating leverage

Unlimited TAM- The wide applicability of Ava’s products especially FFT all but gives it a near unlimited TAM. They operate in a highly fragmented and competitive market, but Ava is positioned as well as any

Aura IQ- After long delays in bringing Aura IQ to the market, FFT’s newest product is beginning to gain traction now with many sites, there is great upside for the business, with great value prop for customers

Land and expand- with thousands of sites worldwide Ava will focus on continuing to expand through their existing customer base across all products and brands

Ai data sets- Like so many companies right now, it’s all about the integration of Ai, FFT has been doing this for a while, and with many companies in this position, they just leverage existing machine learning. The real moat for a business like Ava is the propriety data sets it maintains which leveraged with ever-improving Ai algorithms allows them to improve the quality of their solution and competitive position

Opportunity

Ava is definitely an interesting company, and with its messy history, a simple look may overlook a great company. I think management has done a great job with 2 big ticks for how they have handled the IMOD contract services division to get a great return on the investment and then divest their largest business segment. In a world of ego and status, it would be very easy to keep the business in order to just run a larger one. To divest and then return capital to shareholders to focus on the technology divisions shows a diligent, focused management team in my opinion.

Management had flagged the expected traction going forward with sales to grow substantially higher than their current base ( seen in the previous figure above). I was quite sceptical of the targets however with the growth of ~90% (~50% organic) through the first 3 quarters, they are beginning to hit their targets, and while I do think the targets are too bullish, it shows the confidence management has in the business.

Ava’s businesses especially FFT have been around for a while now and while growth has been lumpy and inconsistent they are genuine world leaders in the security technology space with so many ways to grow I think we are starting to see the ‘inflection point’ within the business as they expand there sales capabilities and capitalise on their opportunity.

Valuation

For a company like Ava the range of outcomes is wild and anchoring to one valuation is very dangerous with the likelihood of being right being extremely low.

Assuming 2023 revenue is in line with management guidance of $29m the figure above shows the likely investment returns given various growth and margin scenarios. Revenue CAGR of >18% and margins of 7%+.

One aspect of Ava’s business model that I don’t love is the one-off nature of revenue. The long-life nature of their products reduces their ability to generate repeat revenue, while they can expand with clients by increasing the number of sites, Ava can’t generate a dependable/consistent/ sustainable revenue base, like a company like Coke, Apple could for example who are non ‘SaaS’ products that generate strong repeat revenue.

What to watch

Lumpiness- As Ava is a project-based business results will be lumpy and revenue won’t be a straight line

Management Execution- Management has put out some pretty eye-watering targets, and so far they are tracking well, only time will tell on the results. I think execution is the biggest risk for the business, Ava’s technology divisions haven’t had a great track record of consistent growth however now they have developed far better infrastructure for growth and I am keen to see how management executes

Aura IQ- Ava’s newest product certainly has a lot of upside potential, given the lengthy delays, and now they have been through all the necessary testing they should be able to roll out their product swiftly

R&D- As a ‘tech’ company Ava needs to keep innovating and developing their products, to provide further value to customers and maintain an advantage over competitors

FFT- I think FFT has the greatest upside potential for Ava given its wide versatilely, competitive advantage and wide application across all physical assets/ infrastructure and there is a large opportunity for very large sites( such as IMOD)

BTQ- As a recent acquisition keen to watch the integration and cross-selling opportunities highlighted by management

I think Ava is a very interesting company, after 12 months of great development ~50% organic growth Mr Market is overlooking it, given the lack of funds flowing into small caps at the moment, it’s no surprise. Maybe if Ava was to market itself as an Ai company we could see some Nvidia-esque revaluing by the market. I suspect investors want to see some profit, given Ava is around the breakeven point, as the top line continues to grow I expected the operating leverage to kick in and then the market to revalue Ava.