Diverger Group is an accounting and wealth management roll-up. Diverger finished FY23 with NPATA of $4.71m and with a market cap of $33m it currently trades at 7x NPATA, 11.6x NPAT and 4.8x underlying profit, with a franked-up yield of 9%.

Off the bat, it needs to be said that Diverger loves their underlying and adjusted metrics, I think those metrics can be meaningful when used sparingly, but Diverger use them every single report, and I think they are absolutely meaningless.

Operations

Diverger's strategy is to make earning accretive acquisitions within the accounting and wealth management space. Throughout FY23 Diverger made four accretive acquisitions:

McGregor wealth management- Acquired 35% equity

AFSL Compliance- acquired 100%

Priority Networking- acquired 100%

Atkinson Saynor- Acquired 55% equity

Without going too deep it’s important to note that Diverge’s ownership in its subsidiaries is very complicated with different structures, equity ownerships, parent companies, and subsidiaries of holding companies.

Accounting

Diverger’s accounting arm which includes The Knowledge Shop, Taxbanter and Taxbytes mainly focuses on providing training to SME accounting firms.

Wealth

Diverger operates a number of businesses within the wealth management space which includes services of:

licensing

compliance

back-office outsourcing

client engagement tools

advice systems

peer-to-peer forums

managed portfolio services

Given the increasing complexity of taxation and compliance, Diverger’s businesses are well-positioned to benefit.

History

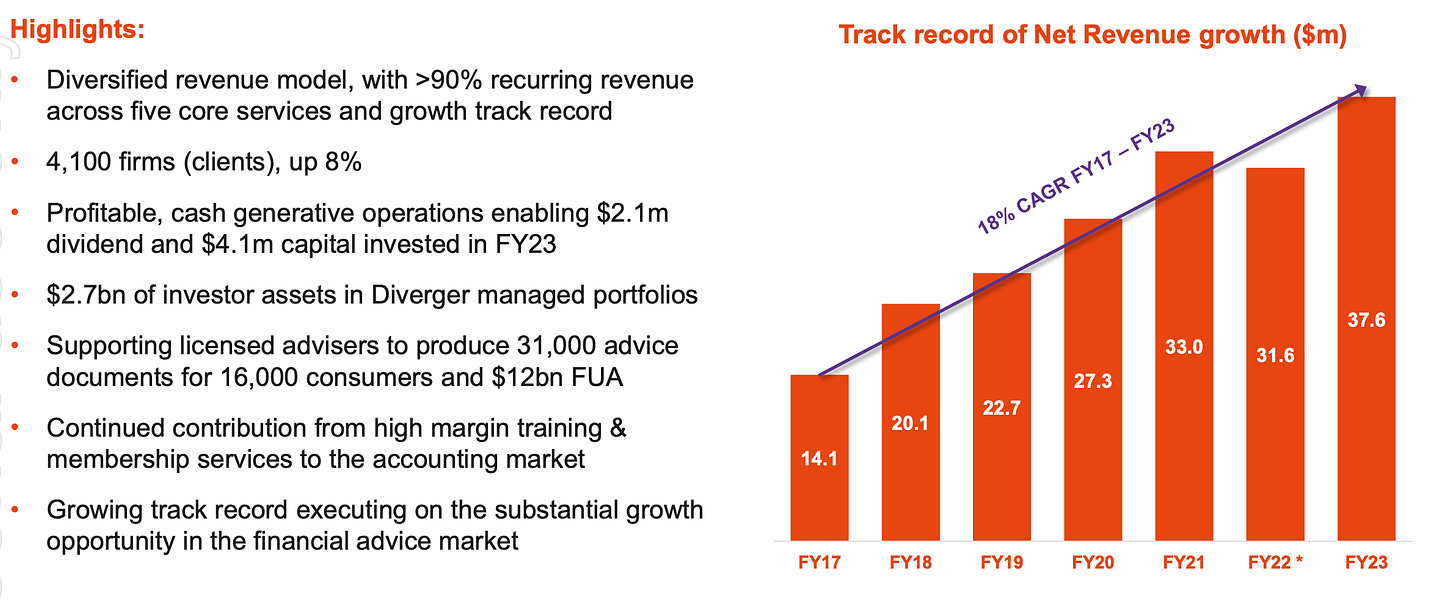

Figure from 2023 results presentation

In 2021 Diverger which was named Easton was renamed to Diverger, “to reflect its culture and growth strategy”- No comment needed.

In Feb 2021 HUB24 took a 31% stake in Diverger which they haven’t sold down and are by far the largest shareholder. Nathan Jacobson a former HUB24 executive was accordingly appointed as the managing director, it was hoped that the partnership would help Diverger leverage technology as HUB24 has to enhance customer experiences. Since Feb 2021 Diverger's share price is down ~30%.

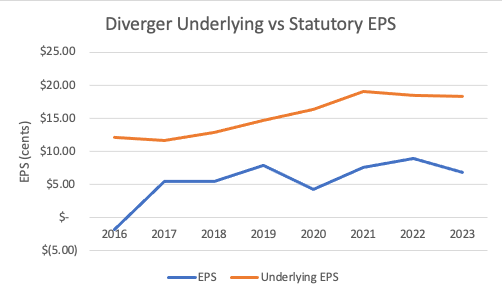

As I learned in year 2, parallel lines are 2 lines that never meet. You can see in the chart above Diverger’s underlying and statutory EPS.

The performance has been quite poor in the last 8 years with very little growth, and statutory EPS never converged with underlying EPS.

In FY23 EPS declined by 22.6% with a particularly poor first half, management attributed the results to growth investments and uncertain market conditions. Management expects FY24 underlying profit to be between $8-9m up from $6.9m in 2023

Outlook

Diverger has an FY25 net revenue target of $40-45m (FY23:$37.6m), and NPATA to $7-8.3M (FY23: $4.7M) as seen below:

2023 results were quite poor and it is expected that they will rebound. Diverger spent $2.8m on acquisitions in 2023 through a mixture of cash and debt with Diverger’s cash balance falling from $2.5m to $0.4m through the year. With plans to continue acquiring business and payout 40-60% of NPATA, there is a real threat of dilution or taking on increasing debt levels.

The bottom line

I don’t own any shares in Diverger as a result of the lack of trust I have in management and the mediocre assets they own. From the outside looking in Diverger’s strategy just seems to be empire-building for the management team, the acquisitions haven’t resulted in any value for the acquired businesses, existing businesses or most importantly shareholders. If management consistently returned 80-90% of profits to shareholders through dividends and buybacks and ran the company for cash, they would likely create a lot of value for shareholders and not just themselves.

Using the assumption of a 90% payout ratio of NPATA Diverger’s 2023 dividend yield would be 12.85%, and 18.36% fully franked. In this scenario, the share price would likely be boosted at a minimum by 30% given the high yield opportunity for investors.

The hope going forward is that consolidation of the financial services industry and increased compliance in financial services and taxation allows for Diverger’s existing business to benefit from the tailwinds through increased spend on compliance and training with the ability for Diverger to make bolt-on acquisitions to their network with cost saving and revenue-boosting synergies, or the potential of a take over.