With a market cap of ~$60m and $30m of cash on the balance sheet, a strong outlook for store growth, and H122 profits of $19m, Dusk looks like an absolute bargain.

Dusk is a specialty retailer of home fragrance products, think scented candles and diffusers, which account for about 66% of sales. Dusk is the clear market leader in this space and has continued to do a simple thing very well, creating sticky customers by offering paid memberships ($10 for 2 years) which account for ~60% of revenue. Like most retailers, Dusk experienced very nice tailwinds from the covid induced lockdowns with FY21 revenue growth of ~50% along with a doubling in profit.

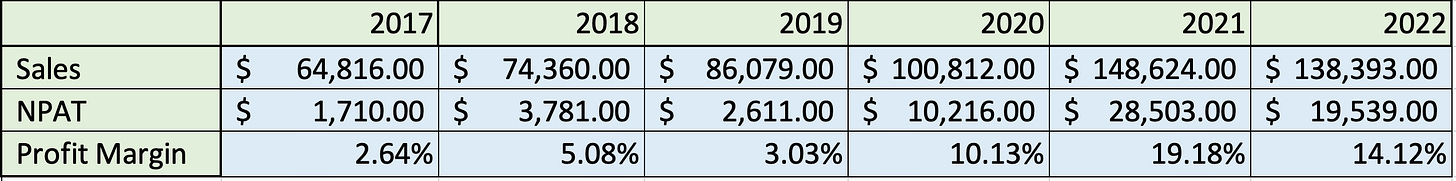

Dusk however is no covid zombie, since 2017 they have grown their store count from 89 to 141, same-store sales from $730k to $960k, and members from 384k to 755k. As of the most recent first-half results, things continue to look good for the retailer, with membership signup up, the opening of 9 new stores and the expansion into NZ. Both revenue and profits are down which was to be expected given the nice bump from COVID and the tightening economic conditions however financials are still significantly above their FY19 levels with management guiding for FY23 revenue of ~$138m compared to revenue of $86m in 2019.

Comparing the financials to the current share price gives some eye-watering valuations:

4.2x H1 2023 profit

2.24x H1 2023 FCF

3x FY22 profit

All this while holding over 50% of the market cap in cash

It’s been 3 years since the first covid lockdown and Dusk’s continued success highlights a strong underlying business, not covid zombie. If Dusk does face a large downturn and then rebounds just to its current levels you could get a very nice return.

Devils in the detail

I see dusk come up a lot with small-cap investors, at first I thought it was just some covid hot online retailer, trading a large discount for a good reason. After my first hour of research, my mind was changed: strong long-term growth in store count, same-store sales, paid members and a market-leading position in the fragrance market. While they did have a nice covid bump they have continued to maintain sales and profits that are significantly higher than the 2019 levels.

Mr Market isn’t stupid tho, and like all retailers, there is a lot of operating leverage due to the large fixed costs required to run stores.

Due to the seasonality of the business, 70-80% of Dusk’s profits resign in the first half of the financial year. In the most recent trading update management guided for FY23 sales to be flat YoY and Pro Forma EBIT of $16-17m down from $26.5m in FY22, but still up from FY19 of $11.8m.

H1 2023 Profit before tax was $19.1m, and with full-year Pro Forma EBIT guidance of $16-17m (excludes the set-up cost of NZ and other one-off expenses) this may highlight what’s ahead for Dusk. Any modest decline in sales will result in a significant decline in Profit and there is a decent chance going forward dusk may be unprofitable.

Crunching the Numbers

I wanted to better understand the cost base and operating leverage of the business so I tried to spreadsheet jockey there situation.

My assumptions for fixed costs were:

Employees- Given that each store only has 1-2 employees at a given time there is little wriggle room to cut employee costs

Occupancy/ rents- Definitely to note that occupancy expense is actually depreciated off a right-to-use asset every year, and is a part of “D&A” and is therefore found on the cash flow statement as “payment of lease liabilities”- does make FCF look better than it actually given this large expense is under financing

Asset maintenance

Marketing*- Is variable but there is a limit in its variability

Other expenses

Variable costs:

COGS

Tax

Other income

I have excluded the IPO and acquisition expenses (was a terminated acquisition)

Note: This model I have built is by no means perfect and there are a lot more qualitative factors required to tell the story than just plugging some numbers into excel.

I wanted to best understand the operating leverage given from FY19 to FY21 revenue increased 72% while profit increased 991%!!!!!!!!!!!!!!!!!!!!!! $2.6m to $28.5m (excluding $6m IPO costs).

So this chart shows the sales sources and expenses for Dusk

Store count- Number of stores at year-end

Same-store sales- Store sales/ no. of stores

Store revenue- Given in results by Dusk or Store count x SSS. Note that they don’t outline store and online revenue in 2018/2019 (shown the red)

Online sales- Sales from e-commerce

Total revenue - Online + Store revenue

Fixed costs- The sum of the previously listed fixed expenses. The figure below shows that fixed costs are pretty fixed and heavily tied to store count and the fact they are tightly correlated to store count will come in handy for confidence of modelling

Variable costs % of revenue- As variable costs are yes dependent on sales, you can see in the chart that they are tightly correlated to sales consistently at around 37% every year, given that most of it is just gross profit.

Variable costs- Sales x variable costs % of revenue

It does give good confidence that both fixed and variable expenses show strong trends with fixed costs correlating tightly to store count and variable costs to sales.

Forecasting

One of the biggest questions for Dusk is how far will sales fall, with very discretionary products coming off strong COVID tailwinds.

This model won’t be perfect but I think its a good directional guide to best understand the upcoming year/s for Dusk

Given the increases in store count, around $75m in fixed costs for 2023 is about fair given the historical trends.

With variable costs of 37% of sales, you can see the crazy operating leverage in both directions.

If sales fall -34% to $90m (from FY23 guidance of $137m) Dusk will lose about $18m with a profit margin of -20% but if sales grow 17% they will make $26m in profit at a 16% margin!

The Ugly

I hope after looking at the forward-looking numbers you can the potential value trap at play here. I currently don’t own shares in Dusk for a few reasons

Candles- My first interaction with Dusk was walking into their store for mothers Day. $40 odd for vanilla, salted Carmel or whatever scented candle. I think candles are pretty stupid but any female will tell you different, how good can a basic scented candle be to pay $40 odd for them, surely the $5 Kmart ones get the job done???? Going forward the expected tightening of the economy would likely hit Dusk very hard with $40-$50 Scented candles and diffusers being very discretionary, and would be the first to go for anyone struggling, with the model above showing how a 30-40% fall in sales would be horrible for dusk.

CEO🚩- Longtime CEO of 9 years Peter King has just recently resigned at the start of 2023, he has done a fantastic job at growing the business, and it’s definitely not a great time to leave for investor confidence. From what I’ve seen there’s nothing too dodgy going on, he’s hung around for 6 months for the handover to the new CEO.

IPO 🚩- The reason for the IPO was for a PE firm to dump their shares, and they maintained a 17% position in the company until about 6 months ago, and have now gotten rid of all their shares

The largest shareholder and long-time CEO leaving 😬

Cash- Dusk currently holds more than 50% of its market cap in cash with $30m as of the most recent report. Looking back historically they do seem to hold a large amount of cash on the balance sheet. Since 2017 they have always held around $20m of cash to probably fund inventories and ensure they can cover unexpected expenses. At first glance, it’s great they have so much cash, but it does make you wonder why they feel they need to carry so much cash. There’s a good chance next year they might not be profitable and if they do have to dip into their cash balance investors may be blindsided by discounting it off their market cap.

Covid- Dusk obviously benefited from more people staying at home being perfectly placed with home fragrance products. It does give me some confidence that while sales are down from their 2021 peak they are still quite strong and a lot higher they their pre-covid levels. Going into a downturn the million-dollar question for Dusk is how deep will sales drop and how fast will they recover if ever they do. Will they recover to a pre-COVID level or a 2022/23 level? Both are very possible outcomes, but drastically different outcomes for investors.

Margins- You can see from the operating leverage within the business that margins are volatile. Once Dusk does recover from the downturn where will margins revert to? I think 2021/22 were anomalies. As of FY23, they have still been able to maintain margins higher than pre covid levels. Forecasting 3% and 10% margins will give you drastically different outcomes and I think something in-between there is the sweet spot, but there is a wide range of outcomes.

Valuation

Valuation is a dark art at the best of times let alone a situation like this.

Assumptions for store growth, SSS and the cost base can be seen in blue

Note: This model is very much far from perfect

All assumptions are in blue

The chart below shows forecasts next to historical numbers

I think this is a likely scenario for Dusk, in which I say with no confidence. FY23 is pretty much done and the forecast is pretty much guidance. But I Assumed store growth to continue in the mid-single digits and add maybe ~15 stores in the next 4 years. SSS I assumed to recover to about the 2022 levels in 2027 to about $950k which inflation-adjusted will be lower than 2022 levels of $960k, but still higher than FY19 levels of $812k.

I assumed fixed costs/ store to grow at about 2%, which would be in line with some sort of inflation, I don’t think retail rents will increase too much given the lower occupancy and likely mean reversion of Interest rates to 3-4%. This model is very delicate if you change the 2% assumptions to 4% 2027 profit would be $3.3m (1.9%) compared to $13m (7.5%)!!!!!!!!!!!

I don’t think specific valuations are great for a company like Dusk given the distribution of outcomes is likely to be very drastic depending on how the future plays out. I could very much see a future where Dusk is a $200m or a $20m business. Both are decently likely.

But anyway, according to my assumptions, I think a PE of about 10 is fair, and there is no real threat of dilution given the large cash balance.

Using the forecast of profit above and a PE of 10 would give a 2027 share price of $2.39

Given the current share price of $0.84 this would yield an IRR of 36.4% not inclusive of dividends

The Bottom Line

I currently don’t own shares, and if I was to buy some it would be a small amount. I have absolutely zero confidence/ conviction in the business. They have done a great job at growing the business, but the long-time CEO leaving isn’t a great sign, I have no conviction in their ability to sell scented candles for $40 going into a tougher environment, it has got to be one of the most discretionary items out there. With the wide range of outcomes, there are just so many uncertainties, but it is just so damn cheap. I think it has the possibility of both being the bargain of the century and a value trap. The million-dollar question is where will margins be in the future and trying to predict that is near impossible.

Things to watch:

Memberships- with members accounting for 60% of sales, members/ signups will definitely be a leading indicator and key variable to watch going forward

Margins- with a large fixed costs base and a lot of operating leverage the whole thesis for your investment will have to be around the future of profit margins

Downturn/ recovery- How far will sales fall, how quickly will it recover, will it recover? All big questions that I have no confidence in any answer in either direction

I think understanding where the asymmetry lies in the distribution of outcomes here will be the key. They are wild in both directions, and I have no conviction in the business going forward given all the uncertainties