Gaming Innovation Group is a capital-light, fast-growing iGaming company boasting 45% EBITDA margins, a strong competitive position and high inside ownership. The true earnings power of the business has been masked by the soon-to-be-divested platform business which presents the opportunity to purchase a high-quality business that has grown revenues at 37% p.a since 2020 with targets to grow 20% p.a organically and increase EBITDA margins to 50% for less than ~13x earnings or 4x EBITDA.

Highlights

Expected divestment of the platform business in Q3 2024

Forecasted IRR of 41.23% across 4 years using assumptions growth below management expectations

Trading at ~4x forward EBITDA/ 10-13x earnings

Revenue CAGR of 37% since 2020

EBIT CAGR of 40% p.a since 2021, €14.2m to an expected €39m in 2024

Management are targeting organic growth of 20% p.a along while increasing EBITDA Margins to 50% (currently 45%)

20% inside ownership with ~20 insider on-market purchases in the last 12 months

Gaming Innovation Group is a Maltese-based iGaming company operating two divisions: Media and Platform prominently throughout Europe. After many years of operating together management along with shareholders have agreed to divest the Platform business, which will likely occur in Q3 2024 to best strategically align the businesses given their different operations. The Media business will continue to trade under GIG/ GIGSEK while the Platform business will be divested onto the public markets with existing GIG shareholders receiving proportionate equity. The opportunity now presents itself to purchase shares in just GIG Media a highly profitable, fast-growing business that’s financials have historically been masked by the unprofitable Platform segment.

Media Business

Put simply GIG media is an affiliate marketing business that generates customers for betting operators. Through their 2 divisions Paid and Publishing they source customers for gambling operators and earn commissions for doing so. The Publishing division comprises of GIG-run websites while the paid division runs targeted ads, with GIG earning revenue via cost per action (9.3% of rev in 2023), listing fees (publishing: 27.9% of rev in 2023) and lifetime revenue share agreements of acquired customers which is there largest revenue stream which accounted for 62.8% of revenue in 2023.

One of the first assumptions of an affiliate marketing company is they have volatile revenue from customer acquisitions and are at the whim of operators and competition. However, GIG earns the vast majority of its revenue via lifetime revenue share agreements of their acquired customers which creates a strong base of recurring revenue. As expected there is a natural attrition of accounts over time with the average account lasting 1-3 years. Operators within the space tend to outsource customer acquisition to third-party specialists like GIG as they are able to generate superior returns while incurring the risk. While it might sound like a commoditised industry, GIG is able to maintain 45% EBITDA margins on the back of their competitive advantages, in Google algorithms, advertising data, and website traffic.

Paid

Paid advertising generated 47.7% of media’s total revenue in 2023, and involves buying ads on Google, Instagram, Facebook, YouTube ect to generate users for gambling operators. GIG uses propriety algorithms allowing them to best target their ads (online casinos and sports bettings) to specific users allowing them to generate superior returns on their ad spend. The competitive edge within this space comes from the size and quality of data, knowing what bonuses, operations, sports, and game types to offer is critical to ensure the the highest ROAS. GIG entered this space in 2017 on the back of the acquisition of Rebel Penguin, where they acquired their propriety algorithm giving them a better understanding of what ads to buy, what to pay and what to show. Paid has become a very important side of the Media business however in recent times has shown only moderate quarter-to-quarter growth in first-time depositors (FTDs). Going forward the paid segment is expected to contribute proportionately less to GIG’s revenue as they continue to make acquisitions and grow their publishing division.

Publishing

The publishing division runs over 150 websites with WSN.com, CasionTopsOnline.com, AskGamblers.com, and Time2Play.com being their most popular websites with their top 5 websites contributing to ~40% of revenue. The main competitive edge within the publishing division comes from SEO which creates opportunities for highly skilled and larger companies like GIG to build and grow websites into popular revenue-generating machines. A key risk that is out of the control of companies like GIG is the Google algorithm, positioning your website best to boost rankings is the best way to ensure high website traffic, however, in the past google has abruptly changed its algorithms and as techniques and strategies change over time its important to keep on top of SEO as once the algorithm falls out of your favour it’s hard to get back. Managing over 150 websites helps diversify the risks and opportunities for GIG allowing for them to position themselves well for any changes in the algorithm or people’s search tendencies. In Q1 24 this happened with Google making a major update to their algorithms which overall had a “minor net positive effect”, however, GIG noted some websites struggled with the changes. In the Q1 update GIG recorded revenue growth of 52% (21% organic) with organic growth in April of 19% highlighting there has been no real slowdown in the growth of the business since Google’s changes.

Casinotopsonline.com has shown a vast decline in traffic which can be the inferred website GIG was referring to its commentary. Being well-diversified within this space is important considering the feedback loops and unpredictable nature. No different to our portfolios, there will be some winners and some losers, it’s the nature of the beast when you're dealing with variables outside of your control, however, if GIG continues to position their websites well on aggregate the portfolio will perform well.

The best signal of GIG’s proficiency within this space is their recent acquisition of AskGamblers in January 2023 where they paid €45m or ~6.5x EBITDA for the website from Catena which had generated €12.9m in the first 9 months of 2022 (a double-digit year on year decline from 2021). Fast forward to the end of 2023 GIG was able to grow revenues by 92% and more than double EBITDA with further growth expected in the coming years. On top of this GIG has recently acquired KaFe rocks in November 2023 for €35m, which includes a number of US websites with Time2Play being the most prominent one. GIG is expected to generate €23m in revenue from KaFe Rocks in 2024 at 45% EBITDA margins, inferring a valuation of <4x EV/EBITDA. Going forward GIG is targeting 1-2 acquisitions per year which in my opinion is a very sound strategy given their ability to bolster up unoptimised websites at attractive valuations. Going forward management is targeting 20% p.a organic growth and wants to increase its presence in the LATAM and US markets, with the goal of growing their US exposure to 30% of revenues helping to uplift GIG to the NASDAQ.

Regulation

As it stands no market accounts for more than 10% of revenues which helps diversify the business from the regulatory risks. GIG only operates in regulated markets however there is always the looming risk of governments banning gambling advertising. Both Italy and Germany have banned all forms of gambling advertising, while countries like Spain and the Netherlands have put tight restrictions on ads. Companies like Google Facebook and YouTube can and have put restrictions on gambling content which can work both ways for GIG giving more value to their propriety data and scale, but can result in lower ad volumes. The risk of websites getting banned is low, and as GIG continues to acquire domains and grow their existing ones its exposure to paid media I think will decline over time to 30-40% of revenue.

Given the existential risks and potential for governments to rug-pull affiliate marketers, it’s important for GIG to remain well-diversified across revenue streams and geographies. As GIG plans to increase its US market exposure it will only increase its concentration risk. Helping mitigate this is the fact that the US iGaming industry is regulated by the states and not the federal government. As it stands 38 US states have legalised sports betting and only 6 online casinos. Sportsbetting in the US was only first legalised in 2018 and represents the largest and fastest growing market hence GIG’s and many competitors’ eagerness to get a foothold in the market.

Financial

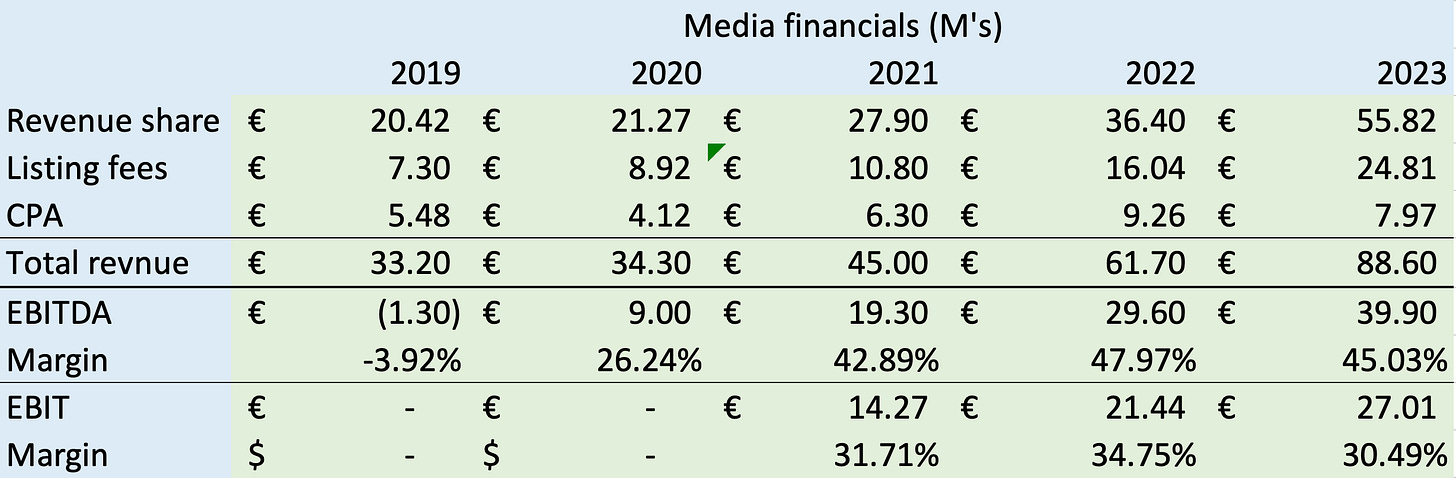

You can see in the financials GIG’s growth and margins are very impressive which is expected to continue as they plan to grow revenue 20% organically and EBITDA margins to 50%.

What the figure above doesn’t show are the large financing costs they have on their debt. As it stood at year-end the media business had €15.5m in cash and €74.5m in debt via bonds.

You can see above the stipulations of GIG’s bonds (350m SEK = €30m), currently, both the 3-month STIBOR and EURIBOR are around 3.9% meaning GIG is paying ~11% on their bonds. Debt has played a significant part in funding acquisitions, which in my opinion is very prudent given the cheap valuations, strong FCF and capital-light nature of the businesses. Going forward GIG plans to fund acquisition via equity which will help reduce their debt burden and leverage. The future acquisitions, capital raisings, growth expectations, and €20m+ in annual FCF should help relieve the debt burden over time helping boost NPAT margins to 20%+. Net finance income in 2023 was -€10m and will likely increase throughout this year as they refinanced their bonds in December 2023. I haven’t been able to find the repayment schedule for the bonds, however, in Q1 they only had €440k in financing costs helping them post a PBT margin of 35% which isn’t sustainable in the short term.

GIG media’s NPAT for 2023 was €12.88m at a 14.6% margin with only 1/3 of EBITDA falling through to the bottom line. Without getting too deep into the numbers, the recent acquisitions have resulted in large additions of intangible assets along with divestment-related costs with both hindering the bottom line. It’s hard without a clean set of numbers to understand with pure clarity how much the amortisation bill is hindering NPAT and what the annual interest costs are.

Going forward post divestment there will be more clarity around interest costs, intangible asset additions, and the true earnings power of the business, but in the short term, it’s hard to get a gauge on margins for the next financial year. I conservatively expect 2024 NPAT margins to be 15% and expect underlying profit margins to increase to 20% as long as the debt burden decreases and the bill amortisation rolls off.

Competition

You can see in the figure above the financials and metrics of a number of GIG’s listed competitors in the affiliate marketing space with there being severe bifurcation in performance between GIG, Better Collective and the rest of the competition. The feedback loops of the data and algorithms are likely the cause of this, and highlight the fact that they can be preserved but when it gets out of your favour, it’s tough. Maintaining consistent top rankings on Google and strong website traffic is difficult, there is intense competition for the same eyeballs, and if you are unable to differentiate yourself it leads to the mediocrity seen in the performance metrics of many of the competitors. GIG has consistently outperformed peers since the management turnover in 2019 which is best highlighted in their financial and customer acquisition metrics and the transformed domains they have bought from their competitors. The figures above only show listed competitors however from my understanding the affiliate space is incredibly fragmented with many tiny players. There is intense competition for eyeballs and an industry where I very much expect a strong power law where leaders like GIG disproportionately obtain value.

Gambling operators operate in a commoditised industry with the only real edge coming from branding. They face intense competition with margins being a virtual race to the bottom. This bodes well for affiliates like GIG who are specialists in acquiring customers, and will only receive more demand for their services from operators on better terms given the intense competition for operators.

Management

Jonas Warner was recently announced as the CEO of the media business after joining the business in 2017 when GIG acquired his business Rebel Penguin. Jonas has run the media business for a number of years now and has been a key part of turning the business around and driving growth and improved margins.

The chart above could only fit the last 12 months of insider transactions and like many of these, I don’t think is 100% accurate however is broadly correct with the continued buying an evident trend seen since 2021 but has significantly picked up in the last 12 months. You have to go all the way back until 2020 to find the last time an insider has directly sold shares and you can see in the table that ‘Juroszek Investments’ has been a prominent buyer. Juroszek Investments and Betplay International represent the Juroszek family who boasts a net worth of US$1.8B having made their money from the iGaming industry in Europe. As it stands they own around 12% of GIG and are specifically interested in the Media business and plan to grow their stake to 25-30% by helping fund acquisitions. They have extensive experience within the industry and maintain a position on the board and it goes without saying are very bullish on GIG media going forward.

Valuation

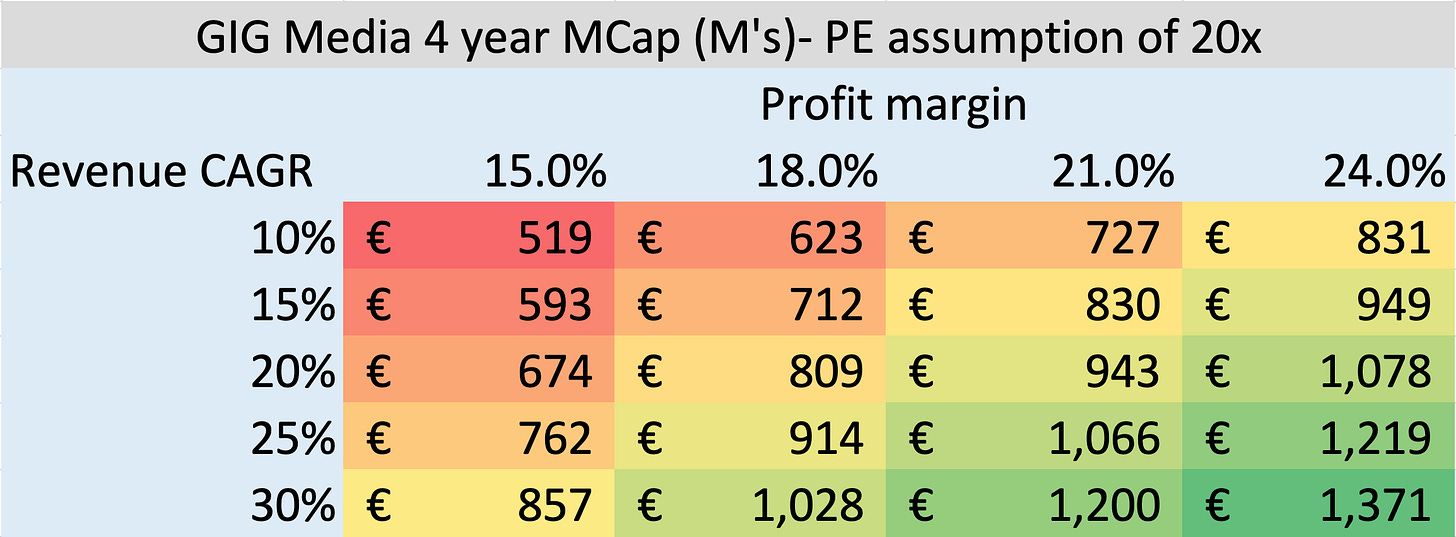

Current Market Cap: € 330m (including platform business)

You can see above the market cap forecasts for GIG media in 4 years with the various organic revenue growth, margin and multiple assumptions. Management is targeting 20% organic revenue growth which will likely be mostly driven by transforming acquired websites. Forecasts expect the European and US iGaming markets to grow 7.5% and 15% p.a respectively over the next 5 years with GIG being well positioned to capture the increased user and gambling volumes. The US market presents a lot of opportunities and as the US iGaming industry develops there will be plenty of opportunity for a company like GIG to partner with operators and acquire key domains with strong tailwinds for the next 10+ years. With targeted 50% EBITDA margins, profit margins should normalise at ~20%+ in the coming 2+ years as the debt levels decrease within the business, contingent on them being able to maintain strong returns on ad spend, and maintain market-leading website and SEO optimisation.

Platform

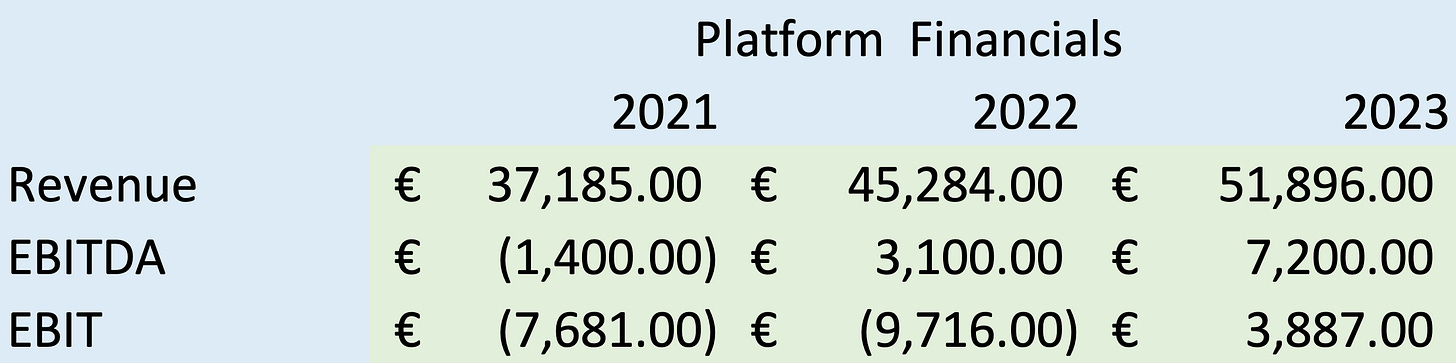

GIG’s Platform business has objectively been holding back the business financials and in my opinion, is the lower quality part of the business.

GIG Platform offers platform and sportsbook solutions for physical and online casino operators offering customisable platforms, data services, sports odds tailoring, player account management, compliance, content management, CRMs, rewards, market services and so on, a soup-to-nuts solutions for operators to build and run iGaming platforms.

Since 2021 the platform business has grown revenues from €37.2m to €51.89m which includes the acquisition of Sportno Gaming in 2022 for €50.8m adding €9m in revenue with €5m in EBITDA. The acquisition was underwritten by Skycity New Zealand a customer of Sportnco which made them the largest shareholder owning 10% of GIG. The business boasts 90% gross margins and in recent years has significantly improved its profitability.

As recent as the 4th of June Platform CEO Richard Carter along with Media CEO Jonas Warner helped complete an €8m capital raise to help fund working capital for the Platform business pre-divestment. Richard runs the company with a wealth of experience as the former CEO of SBtech and Bragg both prominent players within the industry.

The platform business has continually struggled to turn revenues into profit incurring large losses, however, produced its first profit in 2023 recording €3.887m in EBIT. The Q1 update was below expectations with the business recording €8.4m in revenue down 17% with adj EBITDA of -€0.8m compared to €3.6m on the PCP, however, most of the declines were on the back of accounting changes to revenue recognition, and on a like-for-like basis revenue grew 5%. 8 new brands went live on GIG’s platform in Q1 with 4 more expected in Q2, bringing the number of brands using their platform to 67.

GIG’s is a leader within this space, but like many B2B markets, it’s a competitive space. Playtech group is their largest competitor boasting a £1.49B market cap and is listed on the London Stock Exchange and recently recorded 2023 revenue of £1,707 up 7% from 2022 at 23% and 14.6% EBITDA and PBT margins. They provide casino games software, sportsbook platforms and services, betting terminals, data analytics and marketing solutions, very similar to GIG’s solutions.

Bragg, and Gan are listed on the NASDAQ, and along with Everymatrix offer similar end-to-end iGaming solutions such as propriety games, player account management, marketing and operational services, content aggregation and more. Bragg boasts a CAD $193m market cap and recently recorded 2023 revenue of €93m up 10.7% while producing a PBT loss of €2.9m. In the Q1 update things look grim with the business reporting revenue growth of 4% and an operating loss of €1.3m.

Gan has a US $61m market cap and in its Q1 update reported a measly US $30.6m in revenue down 12.27% at a US$4.4m PBT loss. Everymatrix is the stand out from a financial perspective recording 2023 Revenue of €114 up 75% with €60m in EBITDA.

The business has very attractive characteristics with very sticky customers facing high switching costs, with stable recurring revenue and 90% gross margins. If management is able to consistently add operators and grow the business there is significant upside given the likely valuation of the divestment. Using simple heuristics at this current point GIG platform is probably worth 1.5-2x revenue (€78-€104M), or 11-13x EBITDA. The recent capital raising for ‘working capital’ alludes to the fact the business might be struggling to post any decent FCF hence the opportunity for the Media business. While I personally am interested in the Media business there are many people smarter than me more interested in the Platform business like Sky NZ.

Summary

Each to their own, but my interest in GIG comes from the Media business with the divestment a catalyst to unlock the value in the business. Using the assumption of 13x EBITDA or 2x revenue for the platform it gives it a market cap of €100m. Discounting this off the current market cap gives the remaining GIG Media business a market cap of €231m.

*Doesn’t include any acquisitions

You can see my base case above noting 2024 revenue growth includes the acquisition of Kafe Rocks. While management plan to grow revenue 20% p.a organically and increase EBITDA margins to 50% my base case above assumes they slightly miss both of these targets.

With the assumptions above a PE of 20 is about fair in my opinion which brings the 2027 market cap forecast to be €770m.

Discounted back to today's €231m market cap it yields an Implied IRR of 41.23% p.a across the next 3.5 years.

As the Platform business is divested I expect investors will able to see the quality, fast-growing, high-margin business that is left over and has been masked by the measly growth, profit, and cash flow of the platform business. In the short term, there is ample opportunity for growth within their existing European markets as gambling volumes continue to grow, and looking further out the US market presents itself as a very lucrative opportunity for GIG especially if they can continue to bolt-on acquisitions and transform them with their IP and network, with a NASDAQ uplisting a further potential value unlock.

Key things to watch

Regulatory Risk: Both the Media and Platform businesses are well diversified and especially for the media business there is a long left tail if a number of key markets impose tightened regulations on marketing and iGaming. The current valuation gives a more than enough margin of safety for the low risk, however it will be a trend to watch

Algorithms: The Google algorithm does change every so often which can work both ways. The media business has done a great job of positioning themselves well through SEO and diversification, however monitoring website traffic will be a key leading indicator

Debt: The media business has reasonably high debt levels at pretty high rates, and while I assume the burden will decrease over time as they make more acquisitions and repay the loans it is always something to watch.

FTDs: FTDs are the leading indicator for revenue and given the relatively short duration of account activity (1-3 years) it’s key they continue to grow the number. As time goes on, especially in established markets the number of users without accounts with leading operators will decrease as affiliates saturate the FTD market. GIG is well diversified and has a number of growth markets which will help offset a potential decline in FTDs in established European markets. Knowing when volumes might decrease is unknown, but as the industry matures more it will only increase the likelihood.

Nice writeup, you prob saw this or it's a symmetrical coincidence:

https://www.symmetry.dk/wp-content/uploads/2024/03/Symmetry-annual-letter-23-English.pdf