Globe International is a very interesting multi-branded fashion and skating business, with a messy past. I won’t go into detail about Globe’s history as I have already done a write-up on it here.

Since reporting its full-year numbers share price has surged 43% and the business looks to be back on track for now.

Summary of Globe

Misunderstood business- the largest part of the business is the workwear brand FXD, large footprint in Australia, Globe doesn’t layout business segments so this is not a well-known

Through 2020/21 Impala skate and skateboarding hardware exploded, resulting in a higher cost base, large inventories and a lot of profit

As a result of the explosion in skating hardware in 2020/21, sales and profits have fallen from their heights and accordingly the share price

Founded in the 90’s by the Hill brothers who still run the business today while owning 70% of the company.

Since reporting statutory results of revenue down 17% to $234m and profit down 92% to $1.6m the share price has rocketed up 43% as of writing this. The share price is still down 61% from its peak in October 2021, and Globe currently trades at 74x FY23 profit.

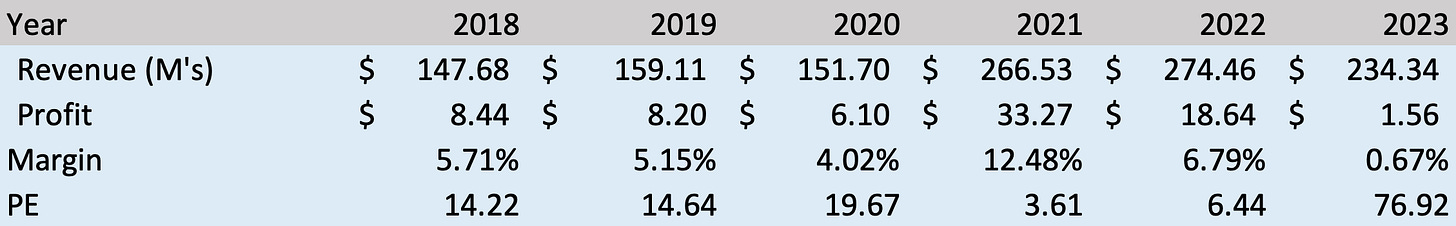

The figure above shows Globe’s historical financials and its current multiple using the historical profits and current market cap of $120m.

Devils in the Details

First glancing at the statutory results Thursday night they didn’t look good at all. It wasn’t until Friday morning I read the CEO commentary and the underlying results were quite good I thought.

The excessive demand for Globe’s hardware goods resulted in a huge glut of inventories, which had to be written down throughout the year through clearance sales. The exceptional levels of inventory also resulted in Globe paying excess for their inventory storage.

Throughout the year Globe had issues with its European division which reported a significant loss for the year. According to the CEO Matt Hill, there were a number of internal management issues within the division that had to be dealt with and the division has been restructured accordingly.

The higher cost base resulting from the explosion in sales throughout 2020/21 had to be reexamined and was done so appropriately, which was one of my main concerns with the business going forward.

You can see from the figure above that when you consider the costs of the inventory glut and restructuring of the European division the result wasn’t too bad given a $78m market cap at the time, however, EBIT is still down from $26.4m in FY22.

As of the release of their full-year results Globe was trading at around 5x their underlying EBIT.

I entered into a small position after reading the underlying results. I still like the business going forward but we are still heading into unknown waters, and I think it’s too early to be putting any reasonable amount of money into the business.

You can see from the figure above the very average result in FY23 besides the Australasia division (EBIT excludes non-cash inventory movements). It is still my belief that FXD is the sexiest part of the business and is my main attraction, which is why the Australian division has held up so well alongside Salty Crew and their other brands, still maintaining a 15% EBIT margin. I think it is quite concerning the numbers coming out of the US and more so Europe. It’s hard to fully understand the numbers given management is so vague with their commentary but I think it’s a good thing that for once a management team doesn’t just try to please ‘the market’. It’s a waiting game now to see how the profitability, growth, and cost management of all the operating divisions and brands hold up. But for now, I still wait on the sideline given the uncertainty.

“There are two concepts we can hold to with confidence: -Rule No. 1: Most things will prove to be cyclical. – Rule No. 2: Some of the greatest opportunities for gain and loss come when other people forget Rule No. 1”- Howard Marks