Kip McGrath is an English and maths tuition business for school-aged students, founded in 1976 out of Kip McGrath’s garage the business has grown to over 500 centres across 20 countries.

After many years of heavy investments, a pivot in its business model, and a tanking share price Kip McGrath is a very interesting company that may be at an inflection point with the heavy investments masking the underlying growth of the business.

FY23 was an interesting year for Kip, after acquiring the US-based tutoring business Tutorly it faced short-term struggles for revenue’s leading to large losses while Kip’s core business continued to progress with corporate centres revenue up 23% and franchise centres up 6%. Over the past 5 years, Kip has been heavily investing in its software platform and more recently into the US market. Since 2019 revenue has grown from $16.2m to $26.7m in 2023 while profits have gone from $2.65m to $1.9m seen in the figure above. The heavy investments into their software platform and their corporate centres have been suppressing margins and masking the underlying growth of the business, CEO Storm McGrath (son of founder Kip Mcgrath) has mentioned the potential for profit margins to grow to ~20% in the coming years, while this is a big ask, Kip currently trades at 11x EV/NPAT at profit margins of 7%.

Since the onset of the COVID-19 pandemic, large amounts of school students have fallen behind due to education disruptions. This educational deficit has created a tailwind for the tutoring industry, with strong demand from households, and increased investments from governments positioning Kip well in key markets.

Highlights

Trading at 15x earnings, or 7x EV/ underlying NPAT

Ability to improve margins from 7% to 15%+

Insiders own 22% of the business increasing their stake by 7% in FY23

Rolling off and realisation of heavy investments

Numerous ways to grow the business organically

Ability to buyback centres at 1-2x earnings

Operations

Tutoring centres

Kip McGrath targets school-aged children charging $69 an hour for their tutoring services. Students are given a free assessment to asses their academic affluence then Kip’s internal software platform creates lesson plans to improve students’ weaknesses monitoring their progress over time. When at centres students are typically put in groups of ~4 monitored by one tutor. The software platform allows tutors to best analyse students’ progression, strengths and weaknesses while allowing for flexibility with students as they are able to complete their tutoring in person and/or online. The average student stays for 51 weeks with a LCV of $3,550 compared to a customer acquisition cost of just ~$220 .

Franchising

As of FY23 Kip had 476 franchisee-run centres down 25 from 2022, generating $17.8m in revenue up 6.3% highlighting the strong growth in students per centre. Kip requires all franchisees to be qualified school teachers giving them access to school and teacher networks, unlike many other tutoring centers. Centres typically tutor around 100 students per week with top locations tutoring 200+ students /week. Average centres turn over ~$340k p.a at a 40% margin, with most franchisees earning ~$100k p.a. Kip McGrath has 2 pricing options for franchisees a gold or silver level. Silver level gives franchisees access to Kip’s National Marketing and tutoring software platform, charging franchisees 10% of centre revenue while the gold level charges franchisees 20% of centre revenue while helping manage all of their back office and admin work such as bookkeeping, payroll, IT support, call centre, local marketing, and money collection. Gold centres represent ~70% of all franchise locations up from 37% in 2016 and are attractive for both Kip and franchisees with Kip generating 2x the EBITDA per centre compared to silver, and franchisees are able to focus on tutoring with less staff, and admin requirements.

Corporate centres

In 2018 Kip opened their first-ever corporate-run centre purchasing it from a franchisee, as of FY23 Kip operates 29 centres up from 24 in 2022 and 16 in 2021. Kip is able to buy these centres off franchisees for 1-2x earnings yielding a high ROI. Corporate centres aren’t as profitable as franchisee centres that typically operate on margins of 40% margin as corporate centres require managers to operate the centres while franchisees manage the centres themselves. As a result of the higher fixed cost base Kip bundles the locations together to enable synergies between locations allowing for managers and admin teams to manage multiple locations lowering the net cost base. Corporate centres are beneficial for franchisees giving them an exit if necessary. Kip doesn’t lay out the profitability of its corporate centres however it was their first year of cashflow positivity within the division (revenue of $7.7m) after a number of years of steadily improving losses, with the expectation of profitability steadily improving over time as they grow their network and the operating leverage kicking in.

Boosting centre occupancy is an easy way to grow the business within its infrastructure and given the large amounts of operating leverage within the corporate centres it will likely be a key driver of long-term growth and viability. After visiting and analysing Kip’s top-performing centres they concluded that the most important aspect to boosting student count within centres is customer service; keeping parents well informed and engaged with the development of their children's academic progression, Kip has been implementing these measures and has seen very strong growth in students/ centre which has offset the decline in the number of centres. Kip has hired a number of their leading franchisees internally to best run and scale their corporate centres.

Tutorfly

Acquired in FY22 to get foot into the US market Tutorfly matches high-performing high school and college students to younger students in need of tutoring. Tutorfly relies heavily on contracted work through school districts. Given the challenges of education through covid the US government has dedicated US$122B of funding for tutoring from 2022-2025. In FY22 Tutorfly contributed $1.6m in revenue ($2.13 annualised) and $41k in profit, fast forward to FY23 Tutorfly had revenues of just $1.2m at an EBITDA loss of $930k. While a very underwhelming year as of the end of FY23 Tutorfly had $2.6m of contracted revenue for 2024. The acquisition precedes Kip’s expansion of centres into the US which is expected to commence in FY24/25. Tutorfly gives Kip the ability to flesh out its US network, brand and trustworthiness, with the ability to integrate Kip Mcgrath centres with their contracted school districts.

Management

Kip McGrath is run by Kip’s son, Storm McGrath. Storm has been CEO since 2007, and maintains 8.4% stake in the business along with Kip who to this day still owns 10% of the business however doesn’t maintain any official role within the business. Total inside ownership is 22.4% of outstanding shares, increasing their stake by 7% throughout 2023 through on-market purchases.

Heavy investments

Just by looking at the cash flow statement, Kip has spent $15.34m on ‘payments for intangibles’ across the last 4 years with a current market cap of $28m that’s a hefty bill. Of that $15.34m $9.914m has been spent on “product and overseas development costs” While the description is vague, it can be inferred that this is Kip’s development costs of its internal software tutoring platform used across all their countries for in-person and online tutoring and has been recently integrated into Tutorfly’s operations.

Kip reported profits of $1.9m with an amortisation bill of $2.47m for ‘product and overseas development costs’ 1.29x their entire NPAT for 2023, and considering they spent $3.2m of development costs in 2023 it’s not just the amortisation but the ongoing cash investments.

For all I know these may be the greatest investments ever giving them a superior competitive position and generating amazing returns for the next 20 years but these are huge bills for a tiny company and taking up a large amount of their cash.

As Kip has rolled out its corporate centres they have had to hire back office and centres staff, as a result Kip’s employee costs have grown at 31% p.a from $3.1m in 2018 to $12.1m in 2023 while revenues have grown at just 15.5%, going from 24% of revenues to 45%. As the corporate centre’s scale and the operating leverage kick’s in I expect the staff burden to decrease over time, however, staff costs won’t go back to 2018 levels as corporate centres require Kip to hire employees internally.

US expansion

Kip’s acquisition of Tutorfly has given them a foothold in the Lucrative US market. In Kip’s 2023 annual report, they said they are “actively exploring greenfield and acquisition pathways in the southern states of the US, with a view to commencing Centre operations shortly.” The US is by far the largest tutoring market for English-speaking nations, and if Kip were able to get any sort of momentum the upside potential would be huge. The downside is Kip’s entering a market where their largest asset, their brand is null. Entering a new market like the US would likely require large amounts of upfront investments into infrastructure, people and systems with no guarantee for returns, however, they may be able to run the business primarily from Australia with a small team in the US or just plug in operations with their existing Tutorfly or Australian teams. I have no real rejections to Kip entering the US market as long as it doesn’t burn large amounts of cash requiring large amounts of CapEx and OpEx with no clear paths for returns, the US has been a graveyard for businesses and is a market where they have to competitive edge.

Outlook

COVID was a big speed bump for Kip, and the subsequent economic challenges especially in smaller markets hasn’t helped loosing 83 (-14.8%) franchised locations from their peak in 2019 seen in the figure above, however in this time franchise revenues have grown from $12.3m to $14.5m up some 17.9%. Kip has a long runway for growth and if they continue to grow market share in under-penetrated markets shown in the figure below their is a long runway for growth.

2022 was a rough year for Tutorfly with revenues falling from $1.6m (9 months contribution) with a $41k profit to $1.2m in 12 months with an EBITDA loss of $930k. Given the already $2.6m in contracted work as of August 2023 for FY24 you can probably expect Tutorfly won’t produce a large loss like in 2023 and burden the company’s results. Kip’s heavy investments are expected to roll off/ decrease in the coming years, and as corporate centres increase and mature the operating leverage within the business should result in profit margins improving to 10%+ (7.25% in 2023, were 17.3% in 2018). Kip has a number of ways to grow the business through opening new franchise centres, upgrading franchisees from silver to gold, improving students/ centre, buying back/ opening corporate centres, Tutorfly, entering new markets, increasing penetration in existing markets, and driving operational efficiency to improve profit margins.

Listening to Storm’s commentary over the following years I expected the heavy investments into product developments to decrease, however the acquisition of Tutorfly and the idea of entering the US market I think has resulted in the investments continuing. The upside in Kip would come from the rolling off of their investments and/ or the realisation of large returns on their investments.

Valuation

The figure above shows the current financials and valuation for Kip. Kip currently trades at ~15x statutory NPAT even after a horrible year from TutorFly, a business potentially under-earning due to large investments and 26% of its market cap in cash. EV/ Kip NPAT= KME total NPAT minus Tuorfly’s $930k loss.

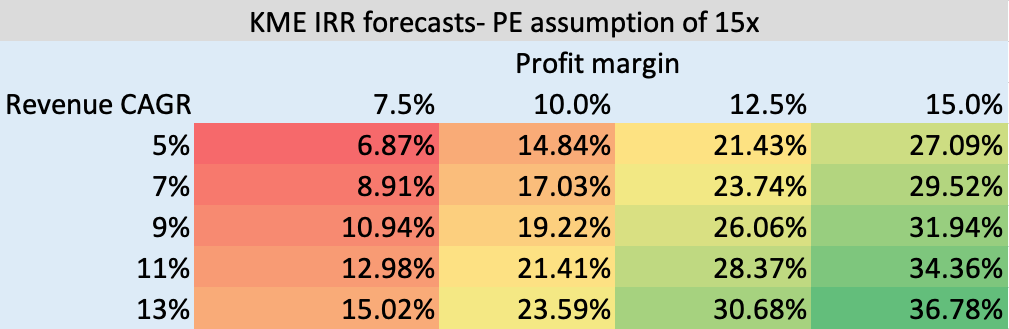

Using the assumption of a 4-year revenue CAGR of 5-13%, with profit margins of 7.5-15% and a PE of 15 you can see the expected returns p.a. Storm has mentioned margins reverting to 15%+ however I will wait until I see that with my own eyes. I have questions about the extent of the profitability of corporate centres and the US expansion, however, if margins can improve somewhat off their low base there is plenty of upside given the decent revenue growth ahead.

You can see though if Kip was able to get margins back to 12.5% with revenue growing at 9% p.a it would likely yield a return of 26% before dividends, you can see from the figure above that the bulk of the heavy lifting from an investment lends will have to come from profit margins.

What to watch

CapEx & OpEX investments- Investors love searching for long-term-minded management teams who are willing to forgo short-term profit for the long term, however anytime managers actually sacrifice the short term, investors seem to squirm. I do have big concerns about Kip’s large amounts of CapEx and the duration of it tho. If Kip doesn’t decrease its large amounts of CapEX investments it will be hard to see margins significantly improve anytime soon, and I question whether the investments will ever yield high returns

Tutoring Industry- Charging $69/ hour for your students to be in a group of 4 seems expensive, and the rise of freelancers and independent tutors could be a headwind for KME, however I doubt it’s a large risk given the success of Kip and the surplus of students to tutors.

US expansion- While the US has been a graveyard for business I can see large amounts of upside from Kip’s expansion. If Kip is able to enter the market delicately and profitably not burning large amounts of cash and risking the existing business I think it makes a lot of sense. The risk comes if more heavy investments are required resulting in large amounts of cash burn wasting Kip's time and resources on unproductive and unprofitable expeditions

Economic downturn- In the situation of an economic downturn or tightening of household expenditure I can see the argument for Kip’s services being resilient and somewhat fragile, however best to just keep a close eye on the situation.

Storm McGrath- I can’t fault Storm too much his communication and strategy seems prudent, however, he is the owner’s son so there’s that, and Kip has been around for a long time and still only has a market cap of ~$30m so the question could be asked is Storm a great manager or just the owners son.