Prophecy International is an Australian-based software company boasting highly attractive economics, tailwinds, and growth, and with the likely near-term inflection to cash flow positivity, it sets up a very interesting proposition to purchase shares in the business at an extremely undemanding multiple.

After IPO in 1997 Prophecy has had a long history of underperformance making a number of random acquisitions in contrasting industries that has proved to be value-destructive for shareholders. Consequently, in 2017 there was a change in tactics with the hiring of the new CEO Brad Thomas and the divestment of 2 businesses, leaving 2 remaining businesses Snare: a cyber security software solution and Emite: a call centre analytics platform. Both Snare and Emite from 2018-2023 have grown ARR at 42% p.a with no signs of slowing down, with as of the most recent half Prophecy announcing revenue and ARR growth of 29% and 21% respectively. As it stands Prophecy trades at ~1.5x ARR, with a quarter of their market cap in cash, a long runway for growth and the potential to be cash flow positive for the full year.

Highlights

Trading at 1.5x ARR with a quarter of their market cap in cash

Grown ARR at 40%+ for the last 6 years

Likely to be cash flow positive for the full year

As of the most recent report ARR and revenue were up 21% and 29%

Highly attractive economics: 95% gross margins, with a highly scalable SaaS model

Strong tailwinds with both industry segments forecasted to grow at 18% & 22% p.a

My overviews of the 2 product offerings are simplified and for the best overview watch Prophecy’s product demonstration on YouTube, which has good insight from the CEO and head of both Emite and Snare on their offering and competitive position.

Emite

Emite is a call centre analytics platform, that allows call centre managers and staff to easily analyse and visualise various call centre-specific data from a number of different inputs (CRMs, KPI management, staff/ sales metrics: call time, no. of calls, average call time, NPS, cost per sale ect as seen in the figure above). Emite is compatible with Amazon Connect, Genesys and Avays all of which are cloud contact/call centre platforms. Cloud-based call centres are growing rapidly, forecasted to grow at 22% p.a, with Emite being a perfect pick and shovels play on the market. The market Emite operates in is very immature with management believing there are no direct competitors and they are clear leaders in the space, with the main alternative being companies turning to internal teams to develop a solution. Both Genesys and Amazon Connect have inbuilt reporting systems like Emite but they fail at a fundamental level especially for large enterprises as they aren’t compatible with solutions outside of the Genesys/ Amazon Connect platforms, which is a challenge for businesses who want high-quality insights for a large team but can only receive data from half of the solutions they use.

Emite is catered to mid to large-sized businesses and is relatively cheap costing users ~$6.9k in implementation costs and ~$1,400 per month with additional costs for usage and for customisation (Amazon Connects website). Hosted in the cloud infrastructure of AWS and Oracle cloud Emite maintains gross margins of 85% and is used by a number of large businesses, organisations and governments around the world such as the ATO, AT&T, Airbnb, Cochlear, Macy’s, Just Eat Takeaway, Colonial First State, Metlife, NZ gov, Johnson and Johnson, Dhabi Commercial Bank, Dubai Health, and Humana to name a few. The fact that Emite is used by a number of the largest businesses in the world, and continues to add and upgrade these users, validates the comments mentioned earlier from management that they are leaders in the market IMO.

You can see in the figure above Emite’s strong growth history since 2020, growing ARR from $4.3m to $16.9m in the most recent half, a CAGR of 48%. You can see in the table above a clear heavy decline in the relative and absolute growth rate of ARR through FY23 and FY24 from FY21 and FY22. Flashing back to 2020-2021, money was slushing around the global economies with big US companies banking heavy profits and spending big. Fast forward to 2022, the story was high inflation, rising interest rates and record-low consumer and business confidence which resulted in a very tough year. It seems everyone has forgotten in 2022 the countless large cost-cutting measures large US companies took up to reduce the bloat created in prior years. A simple Google search backs this thesis up with countless articles, businesses and large VCs mentioning the struggles in B2B SaaS in the last couple of years. Emite has not been exempt from this and the decline in the growth rate from >60% to ~25% is in my opinion on the back of this tightening in spending. I believe this is an important fact to highlight for 2 reasons, 1. The demand for their product and opportunity at hand, that in light of ‘depressed’ demand they have still been able to maintain very robust growth and 2: That Emite may have the potential to increase its growth rate in the coming years on the back of a swing in demand from potentially ‘trough’ levels.

As previously mentioned cloud-based call centre software solutions are forecasted to grow at 22% p.a in the coming years, with many mid-large enterprises needing a simple solution like Emite to configure all their call centre-related solutions into one platform. These 2 factors in my opinion set up very favourable structural tailwinds for Emite’s growth going forward, and beyond this, Emite has a number of avenues to grow within this backdrop. As previously mentioned Emite is sold predominantly through Amazon Connect and Genesys, however, this is only a small portion of the overall market and Emite has the opportunity to expand its market potential by increasing partners and going direct-to-customers. Recently Emite did just this, partnering with with Optus to sell their solution and signing Just Eat Takeaway.com (Menulog in Aus, GrubHub in the US) as their first significant direct customer contract outside of the Amazon Connect and Genesys channels. Following on from this Emite continues to grow internally launching new products such as iPaas and upselling existing customers highlighted in the most recent report with both Humana (their largest customer) and Airbnb upgrading their offering.

Snare

Snare is a suite of cyber security monitoring solutions that enables customers to collect security data from a range of endpoint devices and cloud-based systems. Snare doesn’t protect or stop intruders from entering a user’s infrastructure but put simply monitors if and/or how someone got in and what they saw/took or changed. Snare's major competitors as listed by the CEO are Logrythm, NXlog, Sumologic, Loggly, and SolarWinds, with management believing their main competitive edge in this space is that Snare has been specifically built by people in defence for governments, and can operate in airtight places like planes or boats for example. Just like Emite Snare is backed by strong tailwinds with Snare’s niche forecasted to grow at 18% p.a, favourable economics 100% gross margins (ex commissions) given Snare is hosted within the customer’s cloud infrastructure while being used by a number of the largest businesses/ organisations in the world including the NFL, Charles Schwabb, UK air force, Yum Brands, Australian department of defence, Verison, AT&T and the US department of treasury to name a few.

Snare partners with a number of system integrators such as Fujitsu UK, NTT, Verison, Novocast and Optus to distribute and install their products and on Jan 24th Prophecy announced the strategic partnership with Devo, a US $2b cyber security company. As a part of the partnership, Devo will be including Snare’s endpoint technology in all new and existing subscriptions, replacing its own technology. While the full scope of the partnerships is unknown, this partnership has the potential to add material additional revenue for Snare with no real costs or investments required. Fast-forwarding to the 12th of March, 7 weeks on from the partnership announcement and Snare has added 27 Devo customers at an average subscription value of $38K ($1m+ in ARR), with Prophecy expecting a $1m boost in ARR by the end of the financial year from just this partnership (HY end Snare had $8m in ARR). Devo’s subscription model is different, charging Devo by the volume of data used, and interestingly the implementation comes for no extra costs to Devo users, requires no selling costs from Prophecy while giving Devo customers the ability to gain access to a number of additional snare solutions directly through Prophecy, all of which has the potential to add $5m in ARR to Snare with most of is expected to come in the first 18 months. As you can see below Snare as of Dec 31 had $8m of ARR, and now has the ability to increase that by 62%+ in the coming 12 months, for very little additional costs which will be a huge boost for profitability.

In 2019 management made the decision to transition Snare to a subscription-based model, unlocking the lucrative high-margin recurring revenues. As you can see above Snare has 3 listed types of ARR, with ‘subscription’ being the most high-quality ARR, then maintenance and legacy accordingly. They have been in the process of transitioning clients from their legacy revenue streams to subscriptions, which has taken a lot longer than hoped with governments preferring paying upfront due to their CapEx budgets. In H1 2024 Prophecy highlighted that 61% of all new sales were made on a subscription basis rather than a perpetual license model, with their last 2 ‘legacy ARR’ customers concluding in 2024 as seen in the table above. As a result of these factors, revenue has been flat for the last few years, with legacy and maintenance ARR rolling off while Subscription based ARR has grown strongly from $1.78m in 2022 to $5.4m as of the most recent half. Going forward the trend towards ‘subscription’ ARR should continue resulting in higher quality recurring revenues at better margins, helping boost profitability.

Management

Prophecy has been led by CEO Brad Thomas since 2017 after being promoted from GM of sales. Since 2017 Brad has grown revenue at 14.5% p.a from $9.19m to $22.08m in the TTM, led the transition to recurring revenues which were $0 in 2017 to $25m today, ceased capitalising development costs, and enacted on a number of key partnerships. The bottom line has been very lumpy and in none of Brad’s years as CEO has Prophecy made a profit, which is expected to change in the coming years. While Brad’s tenure at Prophecy hasn’t been a roaring success from a bottom-line perspective, I expect the next few years to be very promising for Prophecy on the back of strong profitable growth. One knock on Brad can be his lack of ownership, only owning 87K shares or $52k worth of shares relative to his $442k salary.

Ed Reynolds is the chairman, largest shareholder, and former CEO owning 10.6% of the business. I have been unable to find anything on Ed, beyond an uncompleted Linkedin profile

Stuart Geros is the second-largest KMP shareholder and the founder of Emite owning $1.7m shares or 2.3% of outstanding shares. Prophecy has him listed as CINO while his LinkedIn has him listed as VP of sales in APAC and it is great to see Prophecy has been able to keep him a part of the business as Emite grows.

Financials

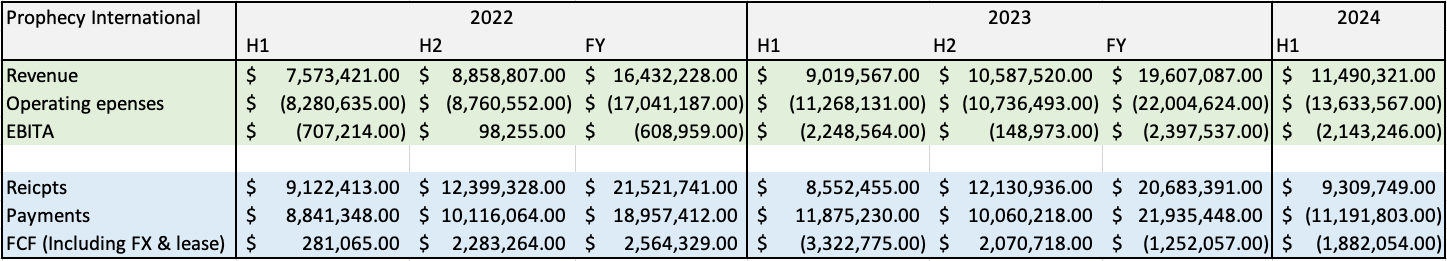

You can see above how messy Prophecy’s financials are, and at face value look very poor which is most likely why the opportunity at hand exists. The ongoing amortisation of intangible assets despite capitalisation of development costs ceasing in 2019, the large and lumpy taxation and subsidies, irregular FX movements, large interest income, and asymmetrical payment cycles all distort the financials, hence why I have used EBITA and shown cash flow.

As you will notice there is a large discrepancy between receipts and revenue due to Prophecy’s negative working capital, which is a feature not a bug of the business model, and combined with the large amortisation and historical cash burn makes FCF a better metric than profit IMO.

Going back to FY2022 Prophecy saw ARR growth of 70% while producing FCF of $2.64m, and on the back of the growth in 2022 they accordingly grew their headcount by 22% to 110 employees, while having to spend $900k for the launch of iPaas (an Emite product) which consequently resulted in FCF falling to -$1.25m in FY23. Fast forward to H1 2024 and you can see a poor profit and FCF result, however, it’s important to note that receipts are heavily weighted to H2 with ~58% of receipts being received in H2 in the last 2 financial years. Considering Prophecy produced FCF of $2.07m in H2 last year there is a potential they can produce $2/3m+ in H2 FCF and be cash flow positive for the full year. While I’m not a ‘catalyst’ investor and don’t invest for it, I suspect investors overlook the company because of the ugly-looking financials but if Prophecy is able to just recreate the H2 2023 FCF result it would likely result in a very large re-rate from the market(TTM they are cash from positive).

My conservative base case scenario is Prophecy won’t be cash flow positive for the full year, but will be in FY2025, and given the ~$11m in cash balance the thesis doesn’t rely on a near-term inflection. However, running the numbers in a more bullish scenario I could see Prophecy posting a FCF result of $3m+ for H2.

Valuation

Between Emite’s 85% and Snare’s 100% gross margins, as a company Prophecy maintains gross margins of 94%, and even when accounting for sales commissions they still maintain gross margins of 87%. Going forward CEO Brad Thomas has mentioned growing ARR/ revenue at 20-30% p.a, and while I think 15-20% p.a is more reasonable there is plenty of upside for growth given the business’s positioning and tailwinds. Given the growth potential, high gross margins, and Snare’s transition to subscription-based revenue, the operating leverage within the business should kick in in the coming years contingent they are able to grow revenue and costs accordingly.

You can see above a range of 4-year IRR scenarios with the given multiple, revenue growth and margin assumptions. You can see the asymmetry of the valuation in the given scenarios above before accounting for the fact 25% of their market cap is in cash, providing a large margin of safety. My base case assumption is a 4-year revenue CAGR of 17.5%, 10% profit margins and a PE multiple of 30x earnings, and using EV would yield a 44% p.a return while just using the market cap would yield 32% p.a, and while the margins may not grow that fast in the given time IMO the multiple would likely counterbalance margins accordingly given that cash flow> profit.

At 1.5x ARR and 1.2x EV/ARR for a business that has compounded ARR at 40%+ and revenues at 15%+ since 2018 and is on the verge of cashflow positivity seems very cheap and is a likely reflection of the messy financials, poor long-term track record and perceived low-quality nature of the company, all of which I believe is being overvalued.

Important variables going forward

Management- Since Brad Thomas has become CEO he has done a great job at growing revenues, building partnerships and transitioning the business to a pureplay SaaS model. His communication has been clear, with the goal of transitioning the business to cash flow positivity in the coming 12 months, and like always the CEO's decision-making and capital allocation will be an important factor going forward and something to watch.

As it stands Ed Reynolds is still the largest shareholder and chairman and has been a part of the business for 30+ years, overseeing a large part of Prohecy’s life as a publicly listed business (with not much success). I haven’t been able to find anything online about him, not even a completed LinkedIn profile, so it’s hard to gauge the circumstances, but nevertheless something important to note.

Cost Control- One of the key variables in the return potential will be managements cost control. Going forward management expects costs to grow relatively slower than revenue, allowing for the operating leverage to kick in and for Prophecy to inflect into profitability. Cost control has been questionable throughout Prophecy's recent history but the higher revenue base should allow for Prophecy’s cost base to become more manageable relative to revenue.

Growth- Top-line growth has been no issue for Prophecy over the last 5 years growing ARR and revenues at 40% and 15% p.a respectively. Given the strong demand and tailwinds for both products, combined with Emites strong competitive position and Snare's key partnerships and network effects there is good reason to believe they can continue to see strong growth in the coming years, and given they are still unprofitable this will be an important factor in determining how profitable they can become, but with the recent Devo partnership, I suspect it will make the transition much easier.

Partnerships- As noted both Emite and Snare have a strong network of partners and system integrators, with the recent partnership of Devo highlighting the upside of these deals. Both Snare and Emite have the potential to leverage existing business networks for their own benefit without incurring many additional costs, and hopefully, both businesses can continue to add strong partnerships.

Competition- Within Snare’s niche there are a number of competitors as previously listed, and given the small scale there is always a risk of entry from larger cyber security players with much larger pockets, resources and connections to dominate the industry through their network and innovation, and the same can be said for Emite.

Emite currently has next to no direct competition as previously mentioned. However, the rise of AI and the low computing costs could pose a threat for Emite, with internal teams and firms able to build a competing product very quickly and cheaply. While the AI is relatively new, the efficiency of building software will only improve over time, and given the current lack of competitors for Emite it will be a key area to watch.

Takeover- While a takeover plays no part in my current thesis, Prophecy seems like the perfect business for a PE firm to get their hands on.