Disc- not financial advice own share of of writing

Soco Corporation is a fast-growing Australian IT services company that provides services targeting the Federal government, higher education, local and state government, engineering and resources and non-for-profits. Soco is unique in that its services only extend across Microsoft software platforms.

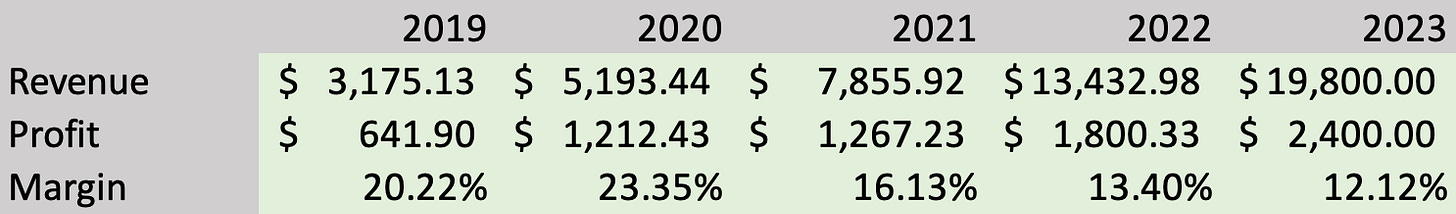

You can see from the figure above Soco’s impressive track record of consistent growth. The figure is from the half-year presentation, with revenue finishing the full year up 47.5% to $19.8m and underlying EBIT of $3.4 up 34.2% (excludes IPO costs and share-based remuneration), trading at just 9x the underlying EBIT.

Operations

SOCO derives its revenue through 4 sources:

Projects-based services: Integration of Microsoft’s solutions (SharePoint, dynamics, azure, business central, power platform + more) into organisations. Fixed price/ scope contracts, and can lead to further contracts.

Support services: Providing adoption, training, governance and support services for delivered solutions and technologies. Vital for businesses to ensure value is realised from investments in their IT systems and that their solutions are aligned with their needs. Typically monthly recurring payments.

Licensing: Given they are a Microsoft Cloud solution provider SOCO provides licensing solutions for all Microsoft software products. SOCO is also a licensing reseller for Nintex, Sharegate and So Suite. Licensing fees generate revenue on a recurring basis

Retained services agreements: Model for Gov clients who prefer longer-term engagements, and charge clients for availability and management of their services and completed work.

You can see from the figure above from the prospectus that SOCO is heavily reliant on the federal government, and the public sector. SOCO has also been able to consistently retain clients with 70% of revenues in FY22 (70%) coming from retained clients, and 95% of their top 20 clients are from FY22.

SOCO’s ideal client is one that is able to commit upwards of $500K to purchase products and requires annual services, which are generally companies with 200- 5000 employees, estimated 3,500 organisations fit this profile in Australia

Being a people’s business, people are a priority and in Jun 2023 SOCO received a score of 97% for “great place to work”

Industry

IT consulting is a highly fragmented industry, ABS data shows the size of competitors:

55.3% (of companies in IT services)- non-employing entities or sole traders

42.5%- between 1-19 employees

2% -20-199 employees

0.2% have more than 200 employees

As of IPO (end of FY22) SOCO had 80 employees.

In FY22 annual expenditure on IT services was around $71B with $6.5B in profits at an average margin of 9.1%, and is expected to grow at around inflation/ GDP.

IT services is highly fragmented which is pretty typical given the low barriers, high competitive nature, and homogeneous offering of participants. Most consultants offer a wide variety of solutions which is why I like SOCO’s approach of just offering Microsoft solutions. Operating within their niche allows them to specialise, partner with other businesses and win customers even if they use other consultants. Power of the model from prospectus extract:

“SOCO delivers niche services (in the broader market context), and therefore often works with a client as part of a vendor mix that includes Managed Services Providers (MSPs), hardware and software vendors, and non-Microsoft application specialists. A client is not lost to SOCO simply because they have an existing IT vendor or an in-house team. The power of this model is that SOCO can win new business by partnering with other organisations that are not directly in competition with it.

IPO

SOCO IPO’d in December 2022 raising $5m with $3.3m dedicated to acquisitions reasons for IPO:

Capital and liquidity for acquisitions: The main reason for SOCO’s IPO was to have the opportunity to grow through acquisition. The plan is to target small IT services companies that align with SOCO’s Microsoft focus that have reached a “growth ceiling”. Ideal acquisitions of up to $1m EBIT. SOCO will have the offering of restructuring/ refocusing the business and offering the synergies of its existing business to help grow the acquired businesses. I imagine their acquisitions as a Kelly partners esk style, definitely not as aggressive, but given their impressive history of growth and success within the industry I expect them to be able to help scale businesses struggling to grow through general operating efficiencies and synergies SOCO offers given their strong momentum. As of August 2023, there have been no acquisitions and they plan to find one in the first 24 months of the IPO

Provide funding for growth initiatives- Raising capital to flesh out staff, and other business costs for growth

Access to capital markets- Improving their ability to raise debt/ equity

Share-based payments- A genuine reason was to give employees access to share-based remuneration to help boost motivation and alignment, which is quite important in a peoples business

The most exciting sign from the IPO was the 5 founders selling non of their existing stakes within the business and now all holding 15.84% of the business maintaining ownership of 79.2% of the business.

Of the 5 founders, 3 remain active within the business as executive directors working alongside the CEO and CFO on the management team.

Financials

You can see from the chart above from 2019 SOCO has seen very nice revenue and profit growth, with revenue growing at a CAGR of 58% and profit at 39%. Margins have been on a steady decline which is probably to be expected given the industry average is 9% and as they grow are forced to target larger projects with heightened competition. Since its establishment, SOCO has been profitable and there has been only one acquisition of a Sharepoint client book in Feb 2021.

The balance sheet is boring and rocks hard, with $5m in cash and no debt as of the HY reports, which is expected given the recent IPO and the nature of the business.

Valuation

Note: 2023 earnings are underlying, using the Underlying EBIT minus a tax rate of 30%

Assumptions for revenue and profit forecast:

Grow at ~9% p.a, not accounting for acquisitions

Profit margins revert to the industry average of around 10%

Share count doesn’t grow- if they do need to dilute for an acquisition it would likely be offset by the accretive revenue and profit

Payout ratio of 50%- Plan to payout 40-60% of profit/ year as of IPO

Valuation

Assumptions for 2027:

I rarely use EV however given the cash position and their plans to acquire a company I think taking off the cash is fair given the cash will result in a rev + profit accretive acquisition

EV= $0.26 (current share price)- 0.040 (cash/ share)

EV=$0.22

Fully franked dividends

PE ratio of 15- Currently trading at around 14x NPAT- excluding IPO costs

Rev of $35m (9% CAGR)

Earnings of $3.5m (9% CAGR)

2027 share price forecast

EPS: 0.0256

PE: 15

Share price: $0.45

+ Fully franked dividends along the way= 0.046/ share

2027 Capital returns: $0.66/ share

Forecasted IRR using these assumptions: 19.% P.A

I wouldn’t be surprised if they missed my earnings forecast with potential growth pains as they scale, however, I believe the acquisition strategy will be quite effective and will be able to offset potential scaling issues.

What to watch

Growth pains- Growth slightly slowed in H2 23, as they scale will they be able to continue to grow at such an impressive rate, when they are forced to target more competitive projects

Acquisition success- I like the strategy given the high inside ownership and success of the business, however, they still haven’t proven their ability to ‘turnaround’ another business, given they still haven’t acquired a business 12 months in shows some diligence in their acquisition strategy.

Management- The founders have been stepping back and while non of them unloaded their shares at the IPO, I am wanting to see what role the founders play in the business going forward

Employee sentiment: As a peoples business need to make sure employee satisfaction remains high

Customer retention: Will customer retention remain high? A key sign of strong operational excellence.

As of now, a have a smallish position in SOCO and am probability going to continue to add shares in the future given the business continues to execute. For me, SOCO has the hallmarks of great investment- with the opportunity to grow share price through multiple expansions, organic and inorganic growth, the ability to offer synergies in acquisitions along with a strong track record and very high inside ownership with are both always a big tick.