Takeover

I wrote this as a shareholder hoping to hold Volpara for 5+ years, but I can’t complain catching a bid at a 50% premium after a nice rally in the last couple weeks (some people obviously knew this was coming).

Lunit provides Ai solutions for detecting lung and breast cancer it boasts a market cap of US$1.8B market cap which is a 7x return for shareholders in the trailing 12 months. For a a company with a market cap of US$1.8B they only have revenues of US$12m (H1 2023) which are up from US$4.6m in the pcp.

Lunit is at the cutting edge for Ai and med tech and while they already offer a density solution, as I mention in this write up, it is less superior to Volpara’s solution and this acquisition makes a lot of sense for them giving them a deeper foothold in the US market and a highly complimentary product to their core solution.

Volpara Health Technologies

Volpara Health Technologies provides an AI-powered software solution to better analyse patients’ breast tissue and breast cancer risks.

In 2009 Ralph Highnam founded Volpara on the back of completing his PhD in engineering sciences and the intersection of Ai and breast imaging. Ralph saw the vast potential of leveraging AI in breast imaging and partnered up with his professor Mike Brady to found Volpara.

After 7 years of product development and commercialisation of their product, Volpara went public on the ASX with ~$2.5m in revenue. Since IPO in 2016, Volpara has grown revenues 15-fold and is on track to boast revenues of ~$40m in FY2024.

Highlights

High-quality ARR- 95% of revenues

High inside ownership ~30%

Market leading position in breast density and image position solutions

Very strong competitive advantages: largest data sets worldwide, 200+ patents, 400+ peer reviewed articles, most market penetration of all competitors

Strong revenue growth and outlook with the ability to compound revenues at >15% for 10+ years

On average 1 in 8 women in their lifetime will be diagnosed with breast cancer with a major risk factor being breast density. Higher breast density increases the risk of breast cancer by 4-6x while making it harder for radiologists to detect the abnormalities as both small cancers and dense tissue appear white on mammograms, as a result, most US states legally require women are informed about their breast density, and this is where Volpara comes in leveraging AI to better analyse the breast density.

Product suite

Scorecard

Volpara scorecard leverages artificial intelligence (in a partnership with Microsoft) and x-ray physics to better evaluate breast tissue composition. It computes volume and fibroglandular tissue from both 2D mammogram and 3D images to produce a density/ volumetric score for each patient. The technology eliminates the subjectivity of radiologist analysis, providing a precise and objective density measure.

After reading through a number of academic reports the gist is that Volpara’s solution provides a more accurate and objective measure of breast density and the associated risks, compared to radiologists who can be prone to human error and biases. While both solutions aren’t perfect nearly all reports highlight the heightened accuracy of leveraging the two methods as it significantly decreasing the risks of patients falling through the cracks.

Analytics

Volpara analytics leverages Ai to increase mammography quality through assessing the positioning, compression, and dose of the mammography helping technologists improve image quality and consistency reducing repeats and recalls of mammographies.

A clinical study published in late 2022 evaluating over 42 technologists and over 210,000 images across 12 months showed a 6% increase in the average quality score, an 8% in images reaching compression standards and a 78% decrease in repeats and recalls from 0.77% to 0.17%.

As of 2023 Volpara had over 400 peer-reviewed papers analysing their scorecard and analytics solution making it most independently validated breast health Ai platform. Reading through a number of them both Volpara scorecard and analytics are consistently used as the standard for measure breast density and quality control on the images.

Patient Hub

Patient Hub was added to Volpara’s product suite in 2019 via their acquisition of MRS solutions adding US$4.5m in ARR. Patient Hub is a software solution for mammography reporting and patient tracking. Patient tracking allows radiographers to track patients medical history, family history, breast cancer risk, educate patients, manage follow up appointments and communicate with patients.

Risk Pathways

Risk pathways was added to Volpara’s product suite via their acquisition of CRA in 2019 for US$18m. Risk pathways uses patient gentic data, medical history, family history, and client surveys to identify and manage high risk patients. They run the data through a proprietary algorithm to calculate cancer risk and better manage high risk patients.

Lung

Volpara lung is a non core product of Volpara and was acquired in their acquisition of MRS, in 2023 Lung only contributed ~$1.4m in revenue or ~4% of Volpara’s total revenues, like patient hub Volpara lung provides a platform for clinics to manage patients lung health and history, and manage the various risks.

Competition

(from 2023 AGM presentation)

Volpara profile

CARR of US$28m, assume ~US$11m is scorecard and analytics

158 employees according to linkdein

100m+ of images

95% of revenues are from the US

400+ peer reviewed reports

Screenpoint

Dutch company focused on European market

Focused on leveraging Ai to detect cancer risk in people with dense breast, not calculating breast density

Product is complimentary to Volpara’s link to studies mentioning this: Link1 Link2

Only 5m of analysed images (Volpara has 100m)

63 employee’s according to linkdein

Densitas

Offers directly competing products, breast density and image positioning

Couldn’t find much information past the website

Very small comapny only 28 employees according to linkdein

iCad

US$38m market cap, down 92% from April 2021

2022 revenues of $27m- down 20% from 2021

Revenues through 3 quarter of 2023 of US$12.5m down 17%

260 employee according to linkdein

Hologic

US$16B market cap

Med techcompany focused on womens health, breast cancers, sexual health, gyneocogical and more, offer a variety of solutions and products

Quantra software is their breast density solution

6k emplyee according to linkdein

Access to abundant resources and images

Radnet

Market cap of US$2.47B

Subsidiary Deephealth provides Ai solutions for Breast, lung and prostate images

Acquired a number of business out of the Netherlands

2022 revenues of US$4.4m for all divisions (breast, lung and prostate)

Radnet is the largest provider of outpatient imaging serivies in america- has acces to large amount of imaging data.

Radnet is a customer of Volpara’s using its analytics solution

Lunit

Korean company US$1.8B market cap

2 solutions for cancer detection of lung and breast cancer

H1 2023 revenues of $12.6m up from $4.6m in 2022

Incredibly well capitalised, investing heavily into growth

~7m breast images, targeting global markets

Core product is using ai to detect cancer, with breast density complimentary to this

Data is king in this field, the better the data sets you have, the better you can train the Ai, the more effective your solution is, the more customers you win, the better your data sets are and so it repeats, from my understanding Volpara has genuine market leadership in the US market for breast density analysis and image quality solutions. Lunit poses a significant threat going forward however there density solution is complimentary to their core solution, and less complex given it has significantly less data. Both Radnet and Hologic are large organisations that have access to vast amounts of resources and the ability to outcompete Volpara. Breast density and Image quality tracking is an incredibly niche market and the beauty of it for Volpara is there isn’t enough of an opportunity for larger firms to go hard at it while smaller firms struggle gaining market share due to low product validation and lack of input data.

Volpara’s competive position sits very well with:

15+ year experience in the industry

Highest market share of direct competitors

400+ peer reviewed articles on their solutions (by far the largest)

Scorecard and analytics are both industry standard for academic studies

~45%+ of all patients receiving a mammography interacting with a Volpara product

Have the largest data set of mammogram images: 100m+ images

100+ patents on their technologies

Net revenue retention rate of -112% with <2% churn

With the rapid innovation in Ai anything is possible, but given Volpara’s large data set, market position and partnership with Microsoft they seem well positioned to grow their moat in the US market.

Financials

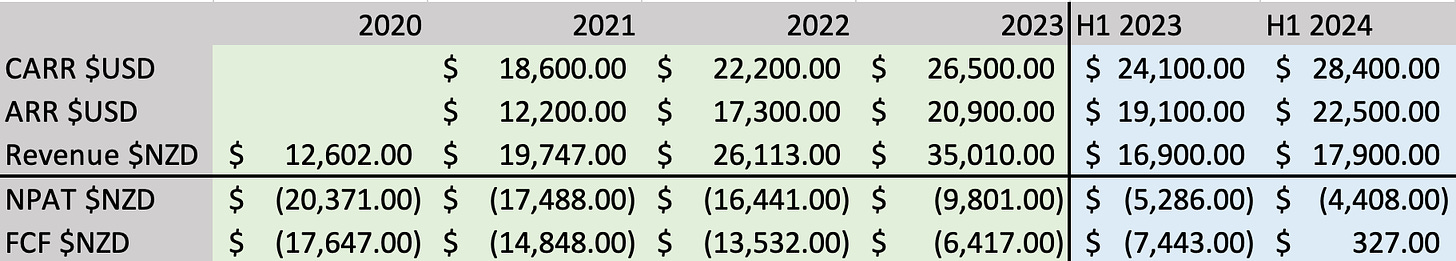

Volpara has a long history of very strong growth but it has come via large amounts of cash burn. Since 2020 Volpara has grown revenues at 40.6% p.a (includes 1 acquisition) with 35% p.a organic growth, and while they have pivoted to focussing on profitability the cutting of costs revenues hasn’t burdened revenue growth.

Late November Volpara released its half-year financials and while expenses have been flat the rate of growth continues to expand with core subscription revenues up 27%, (Scorecard, analytics, patient hub and risk pathways). Management expects FY24 to be Volpara’s first financial year of cash flow positivity after $136m in accumulated losses, with the CFO mentioning in the call they are 18 months ahead of expectations (regarding cash burn/ profitability). In the TTM Volpara has generated $753k in FCF and has been cashflow positive in every quarter since Q2 2023.

The fact that they have been able to maintain strong growth without growing costs and are 18 months ahead of their own internal profitability forecasts highlights to me the quality of their product offerings, the strong demand from clinics and the capital light/ scalability of their business model.

However the questions has to be asked if this is all true, why did they have such poor cost control in the first place?

CEO Terri Thomas has only taken over since April 2022 and so far has done a very good job at ‘turning around’ the business after the $136m in accumulated losses, so its hard to knock her too much.

Outlook

We are at the tip of the iceberg in term of Ai and its applications, and going forward Volpara’s algorithms are only going to become more effective with clinics also more likely to adopt Ai solutions.

As it stands around 45% of women in the US who receive a mammography will interact with a Volpara product and while this isn’t a great guide for market share given Volpara offers suite of products it tells me that Volpara is both well entrenched in the US mammography market and has a long runway for growth.

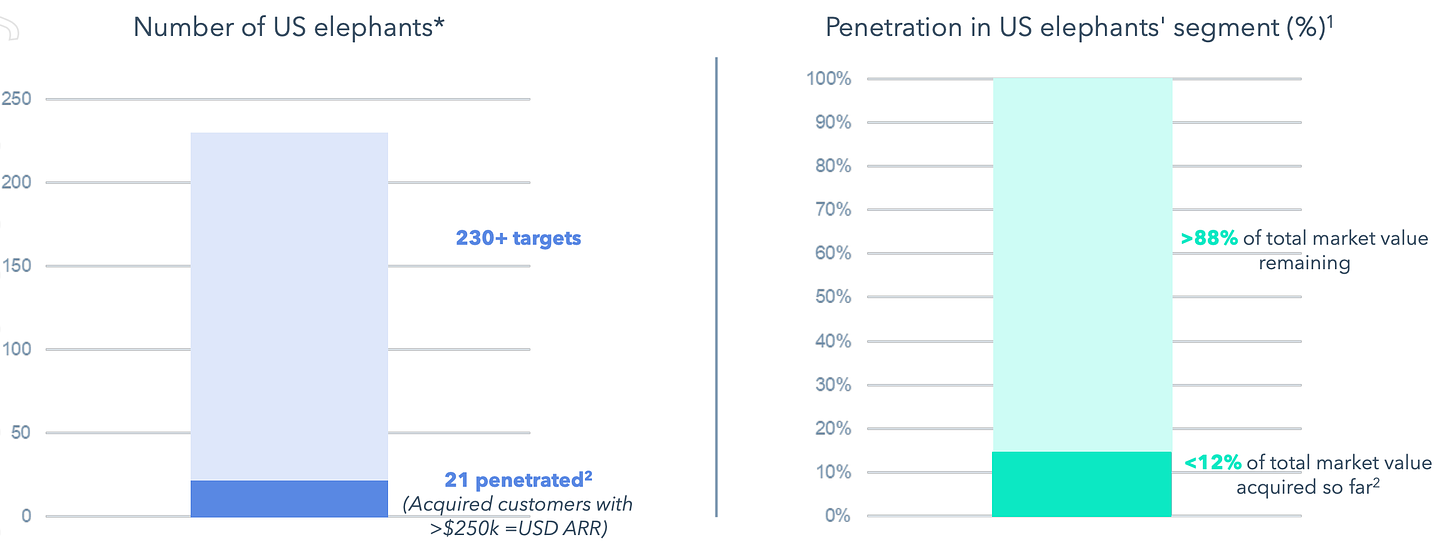

(from 2023 AGM presentation)

Volpara identifies clients as calves ( >$100k in CARR) and elephants ( >$250k in CARR) and you can see above Volpara’s market opportunity of elephants according to themselves. In 2023 Volpara grew there ‘elephant’ count from 10 to 21 and have already added 9 new ‘elephants’ in H1 2024. Signing larger customer more often is always a great sign, and is evidence of the increased acceptance of Volpara’s solutions and Ai amongst larger layers in the industry. Going forward I expect this trend to continue as Volpara increases its number of reference sites amongst larger clients increasing its product validation and further improves its algorithms.

Volpara recently announced in there H1 presentation further expansion into the European market. Currently 96% of revenues are sourced from the US and it is by far the largest market. However Europe has historically lagged in the uptake of software solutions but management reckons they have seen increasing adoption which has prompted them to begin their European expansion. There are always many risks and opportunities when entering a new market, and while I don’t have any strong opinion on the expansion it will be something to watch given Volpara’s focus on transitioning to profitability.

With Volpara’s large dataset and the rapid developments in Ai the applications of their technologies will only increase with Volpara themselves mentioning they are planning to launch a new product in the coming 6 months.

Valuation

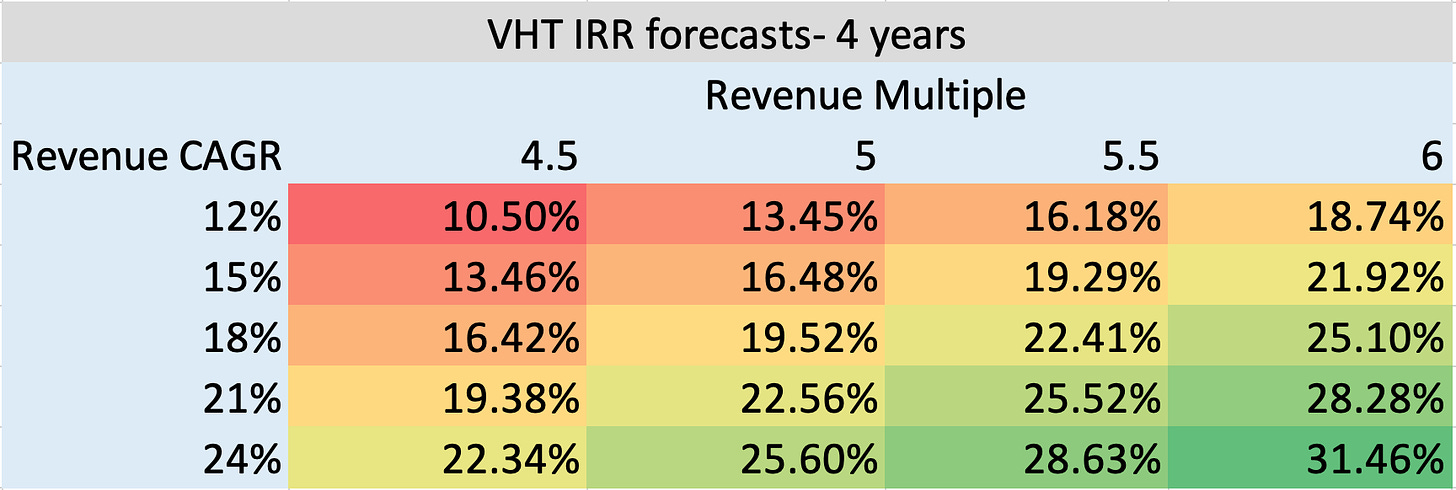

I think a range of 12-24% for revenue growth is about fair with 18% probably the most likely growth rate across the coming 4 years. Its hard to use a profit multiple and/or predict the profit margin in 4 years and I think using a revenue multiple is more suitable. I think 5-5.5x revenue is about fair given Volpara’s super high gross margins of >90% and a business that at scale will be very profitable with the potential to maintain margins of 20%+.

While this isn’t in my thesis and and I don’t invest for this, an Ai-medical software company could very well catch a very nice premium, especially once they become profitable and going forward heavy multiple expansion could yield some nice returns for investors.

What to watch

Partnership with Microsoft- I think there is next to 0 risk of Volpara losing its partnerships with Microsoft, however it is a key counterparty risk given they are the source of Volpara’s Ai

Profitability- Volpara needs to ensure they continue on their trajectory of getting to profitability and cash flow positivity. With very high quality recurring revenue I don’t think it will be too hard for Volpara to transition

Competition- Companies like Lunit, Hologic, Radnet have abundant resources and are direct competitors of Volpara, while right now Volpara has the competitive edge going forward things may change and its something to watch

Valuation- Volpara trades on around 5x ARR and while I think this is about fair its very much priced for growth and any slowing in the growth rate could very likely result in the multiple shrinking

I think Volpara is a company the if you are able to be patient over a number of years you will look back and receive a nice return. Its by no means cheap but given the opportunity, competitive position and business model I think Volpara has the potential to grow revenues at ~15% p.a for 10 odd years and maintain a profit margin of 20%+.